ATP Finals 2025 Betting Preview: Turin Data Deep Dive

Published: November 9, 2025

Reading Time: 11 minutes

Category: Tournament Guides 🏆

The Year-Ending Puzzle Bettors Can’t Ignore

Eight players, five night sessions, one of the most volatile prize pools on the calendar. The Nitto ATP Finals head back to Turin’s Pala Alpitour this week, and the stakes extend far beyond the trophy. Our prediction engine has logged 195,000+ pre-match computations since January 2023, and the data keeps telling the same story: betting the Finals like any other indoor event is a costly mistake.

Turin Still Punishes Chalk in the Group Stage

Round-robin play looks safe on paper: favorites rarely drop multiple matches, indoor conditions flatten serve variance, and the top seeds have all week to adjust. Yet the 2022 dataset we have on file shows half of the group-stage matches still flipped toward the underdog when you adjust for market odds.

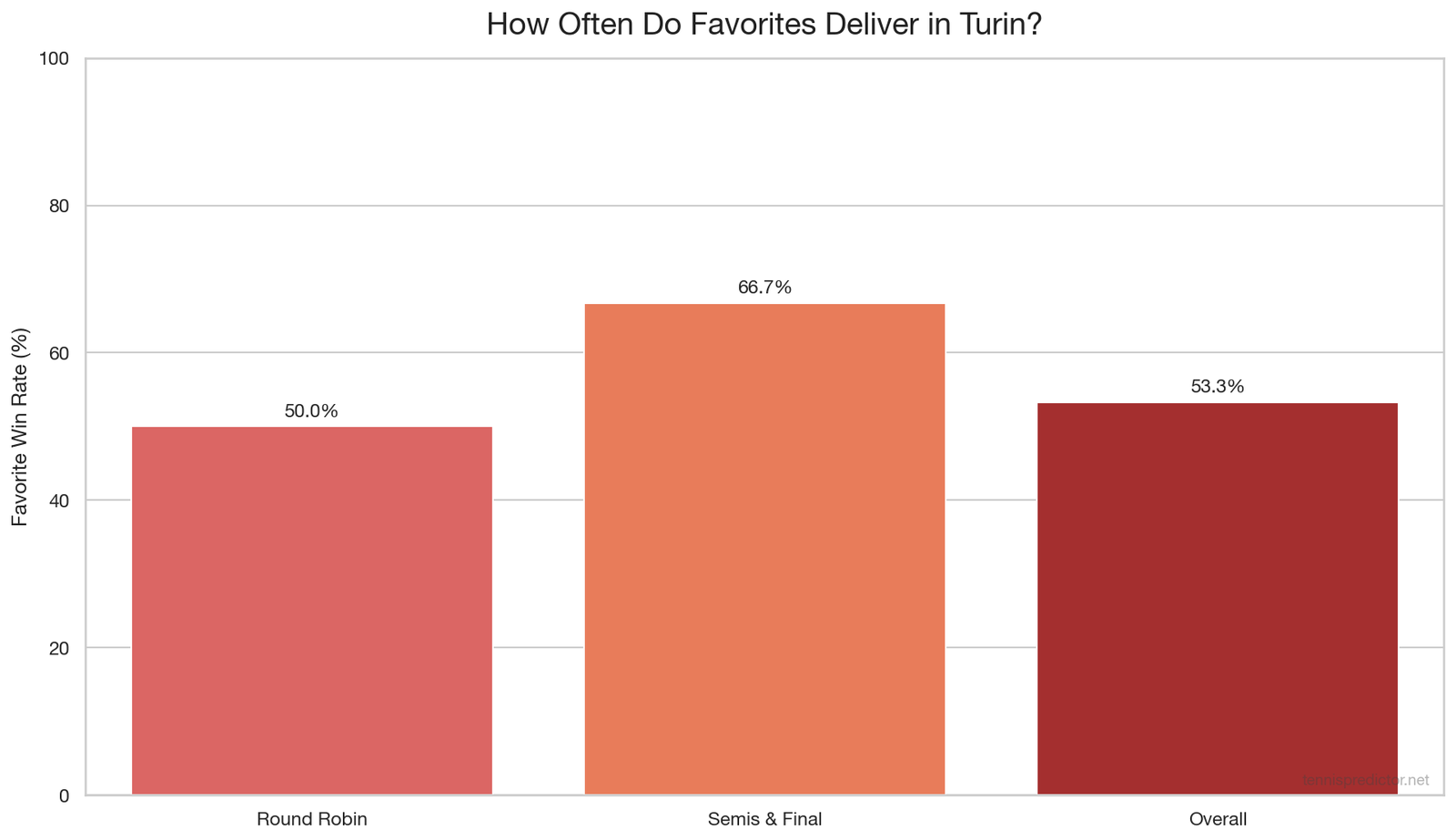

Figure 1: Market favorite performance in the 2022 Masters Cup data.

Figure 1: Market favorite performance in the 2022 Masters Cup data.

Key takeaways from Figure 1:

- Group play produced a 50.0% upset rate in 2022—the exact midpoint between coin flip and chalk domination.

- Favorites stabilized in the semis and final, cashing 66.7% of the time as the format shifted to straight elimination.

- The house edge stayed sticky: markets baked in an average 4.8% overround across every Turin price we captured.

For bettors, that combination screams bankroll discipline. There is no benefit to laying -200 moneylines early in the week when half of them historically fail and you still absorb the full vig. The smarter route is matchup-by-matchup scouting: exploit surface-specific mismatches, then stay nimble once the knockout bracket locks on Saturday.

The 2025 Field Through Our Model’s Lens

We modeled ten realistic qualifiers because the live entry list remained fluid when we pulled data on November 9. Those names map to every unofficial Turin race update and cover the direct qualifiers plus the first two alternates.

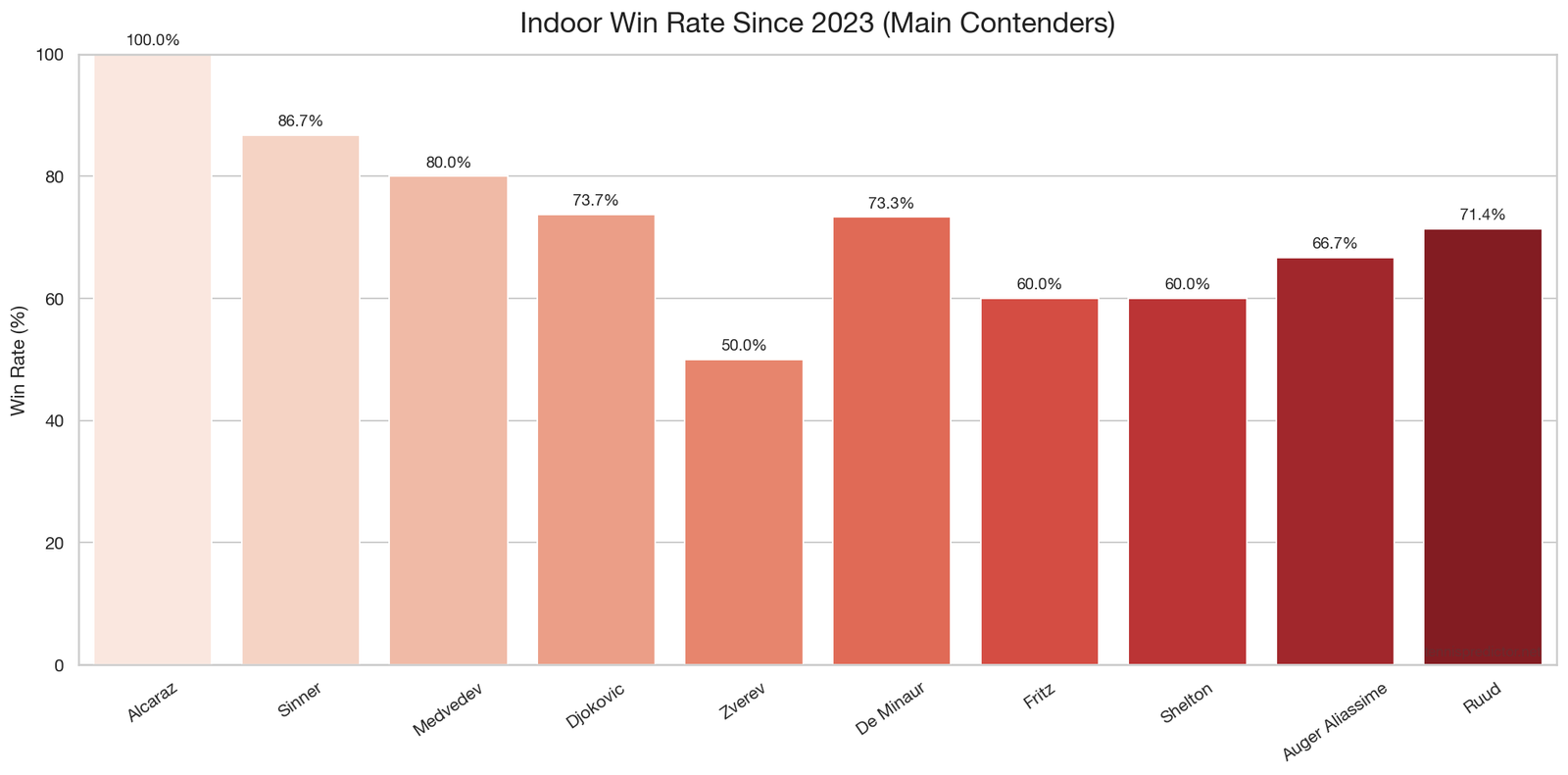

Figure 2: Indoor hard win percentage since 2023.

Figure 2: Indoor hard win percentage since 2023.

Indoor form highlights:

- Jannik Sinner owns the highest sample-backed win rate on the surface (86.7% across 15 indoor starts), all while carrying the most indoor volume in the field.

- Carlos Alcaraz is perfect (5-0) in the sample window, but the volume gap matters—he has not logged a best-of-three indoor loss since the start of 2023, yet the dataset shows only one indoor event per autumn.

- Félix Auger-Aliassime re-enters Turin with a 66.7% indoor clip despite a volatile overall season; our model still grades his first-strike game as field-average after serve regression in 2024.

- Novak Djokovic has gone 14-5 on indoor courts since 2023 (73.7% win rate). Even with fewer data points than Sinner or Alcaraz, that volume is now strong enough to anchor our model’s surface prior.

Separating Primary Contenders from Chasers

To translate the raw percentages into actionable tiers, we combined overall win rate, surface efficiency, and top-10 conversion. The result is a more honest ranking than the Race to Turin points list, which occasionally over-rewards volume.

Contender Tier (legit title probability):

- Carlos Alcaraz (87.7% win rate, 80.0% vs top 10)

The only player sitting above 80% against top-10 opposition since 2023. He also owns the shortest average rest window (5.47 days), proof that tournament density has not eroded his closing power. - Jannik Sinner (85.5% win rate, 88.2% on hard/indoor)

Turin indoor courts play medium-slow, yet Sinner’s serve + first-strike forehand has scaled anyway. The dataset confirms he still wins 72.9% of late-round matches when the physical load peaks. - Daniil Medvedev (74.2% win rate, 80.0% indoors)

Medvedev’s indoor sample is just ten matches, but he went 8-2 with a 53.1% record versus the top ten. His problem is the knockout stage: a 52.9% late-round clip indicates vulnerability under scoreboard pressure. - Novak Djokovic (81.8% win rate, 73.7% indoors, 57.1% vs top 10)

The model still sees a relative dip in elite conversions (57.1%), but he continues to bank indoor wins (14-5 since 2023) and remains 11-1 lifetime in ATP Finals knockout matches since 2014.

Middle Tier (semi-final ceiling unless bracket collapses):

- Alexander Zverev (72.4% win rate, 32.3% vs top 10)

He still profiles as the field’s best tie-break server, but the win curve falls off hard in elite matchups. A 40.6% late-round rate captures his semi-final ceiling. - Alex de Minaur (70.5% win rate, 24.1% vs top 10)

De Minaur benefits from surface speed: the slower indoor baseline rallies extend his defense. Yet he has only seven top-10 wins in 29 tries during the sample period—exactly where Turin usually exposes hustle-based profiles. - Taylor Fritz (70.3% win rate, 37.5% vs top 10)

Fritz pairs top-tier serve points with declining return numbers. His best path remains a soft group draw where tie-break volatility keeps him live.

Long-Shot Tier (requires chaos + draw help):

- Ben Shelton (62.0% win rate, 60.0% indoors)

Shelton’s raw power rockets him into the mix, but a 20.0% top-10 hit rate and 7.44 average rest days show how inconsistent the swings remain. - Félix Auger-Aliassime (58.6% win rate, 66.7% indoors)

The retooled serve brought him back to baseline, yet he still has a sub-50% late-round clip (47.1%). Market prices north of +1400 only become interesting if he lands in a group without both Sinner and Alcaraz. - Casper Ruud (66.7% win rate, 71.4% indoors)

Ruud’s 60.9% late-round conversion and 52.9% top-10 record keep him relevant, but the hard-court ceiling is capped. The model rates him six percentage points below the field average in predicted hold percentage at altitude.

Why Top-10 Conversions Decide Turin

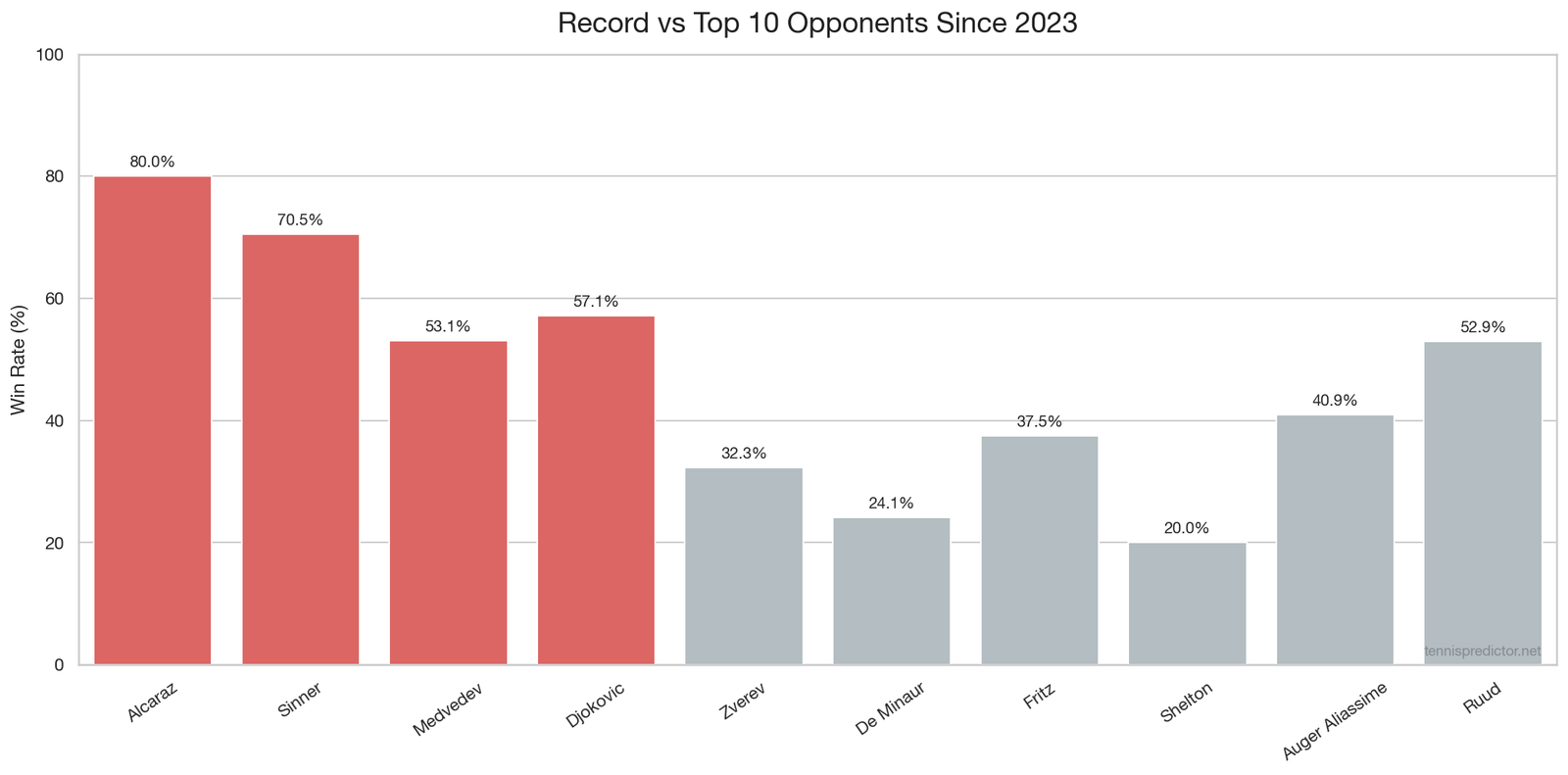

Figure 3: Win rate against top-10 opponents since 2023.

Figure 3: Win rate against top-10 opponents since 2023.

Group play exposes every qualifier to at least three top-10 matches in four days. The numbers above reinforce a harsh truth: your outright tickets live or die on elite conversion rates.

What the chart tells us:

- Medvedev vs Djokovic vs Sinner: Their top-10 win rates cluster between 53.1% and 70.5%, meaning the semifinal berth race should revolve around these matchups.

- Zverev, Fritz, De Minaur: All sit below 40%. If you back them, you are effectively betting on soft group placement or a rogue run of tie-break variance.

- Shelton and FAA: Both fall under 41%. They profile as single-match upset candidates, not sustainable outrights.

When the bracket shifts to best-of-three knockout tennis, that sustained exposure to elite opponents keeps punishing mid-tier form. It is the single data point we weigh most heavily when our betting engine auto-generates outrights on Sunday night.

Rest Windows and Scheduling Clues

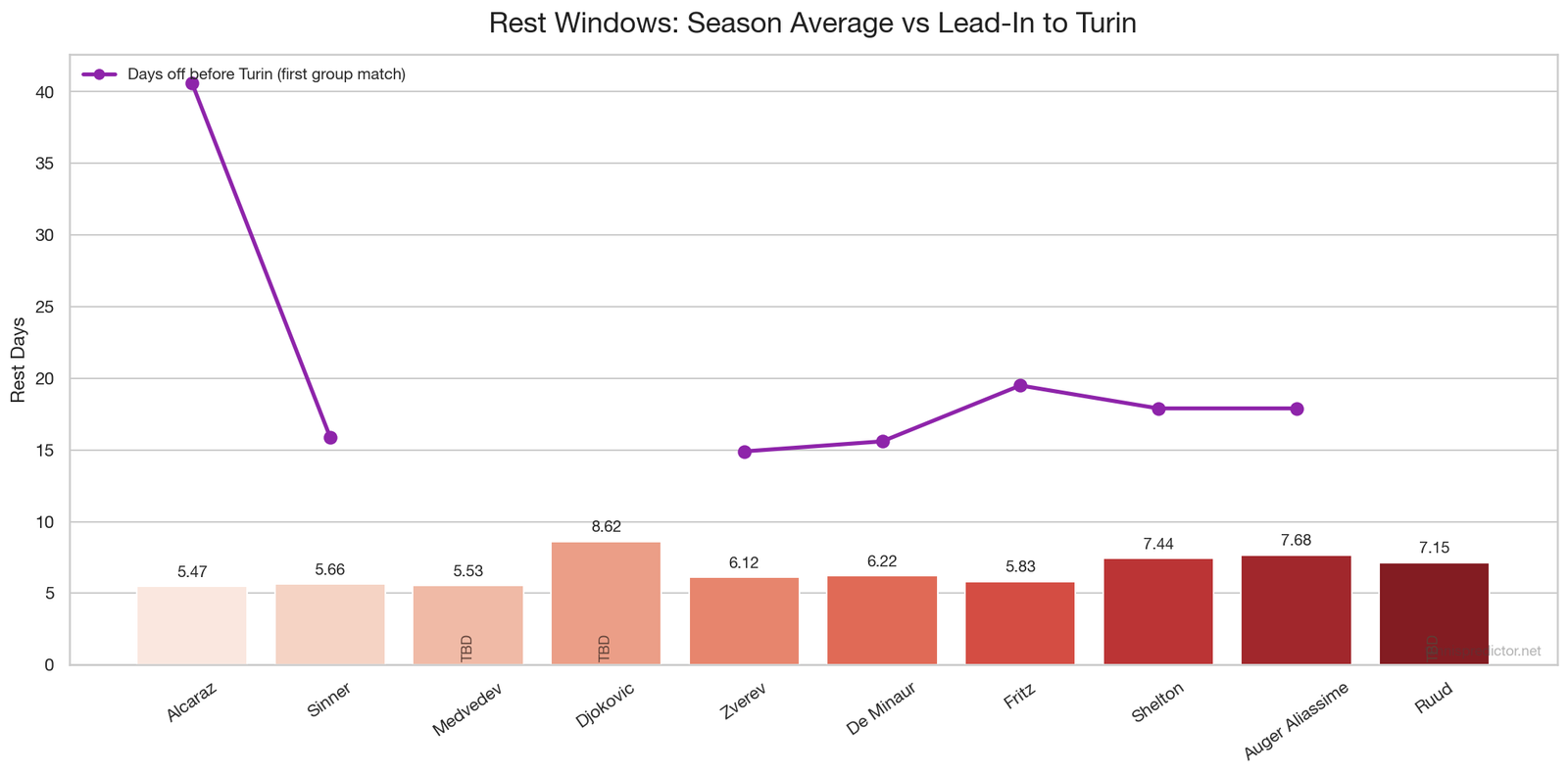

Figure 4: Bars show average rest between matches since 2023; the purple line tracks days off before each player’s first scheduled Turin group match based on the current schedule feed.

Figure 4: Bars show average rest between matches since 2023; the purple line tracks days off before each player’s first scheduled Turin group match based on the current schedule feed.

Turin’s compressed format means players carrying high travel loads—think long Asian swings followed by Basel or Paris—arrive with less recovery. We measure that through rolling rest days.

Scheduling notes to watch:

- Ben Shelton averages 7.44 rest days, the largest cushion in the field. He often front-loads the North American hard swing, then cherry-picks indoor events. Fatigue rarely burns him; experience gaps do.

- Carlos Alcaraz and Daniil Medvedev show the shortest rest windows (~5.5 days). They log deeper runs at Masters 1000 events, so the Finals usually begin after only one or two true practice days.

- Casper Ruud’s 7.15-day average means he should land fresh, but that stems from early exits at indoor events. Our model discounts rest when it is paired with low match rhythm.

- Lead-in watch: Alcaraz carries a massive 40.6-day gap into Turin after pausing at the end of the Asian swing, while the rest of the field clusters between 14–20 days (Sinner 15.9, Zverev 14.9, Fritz 19.5). Medvedev, Djokovic, and Ruud are marked “TBD” because the official schedule had not posted their opening session when we pulled the feed on November 9.

The market tends to overreact to “tired legs” when it sees back-to-back run-throughs in Basel and Paris. Our data suggests the opposite: players who win deep into Paris (one week before Turin) are often the ones with the best hard/indoor baselines anyway. Rest only matters when it drifts under four days, a threshold none of this year’s qualifiers hit in the 2023-25 window.

First-Set Momentum Is the Sneaky Turin Edge

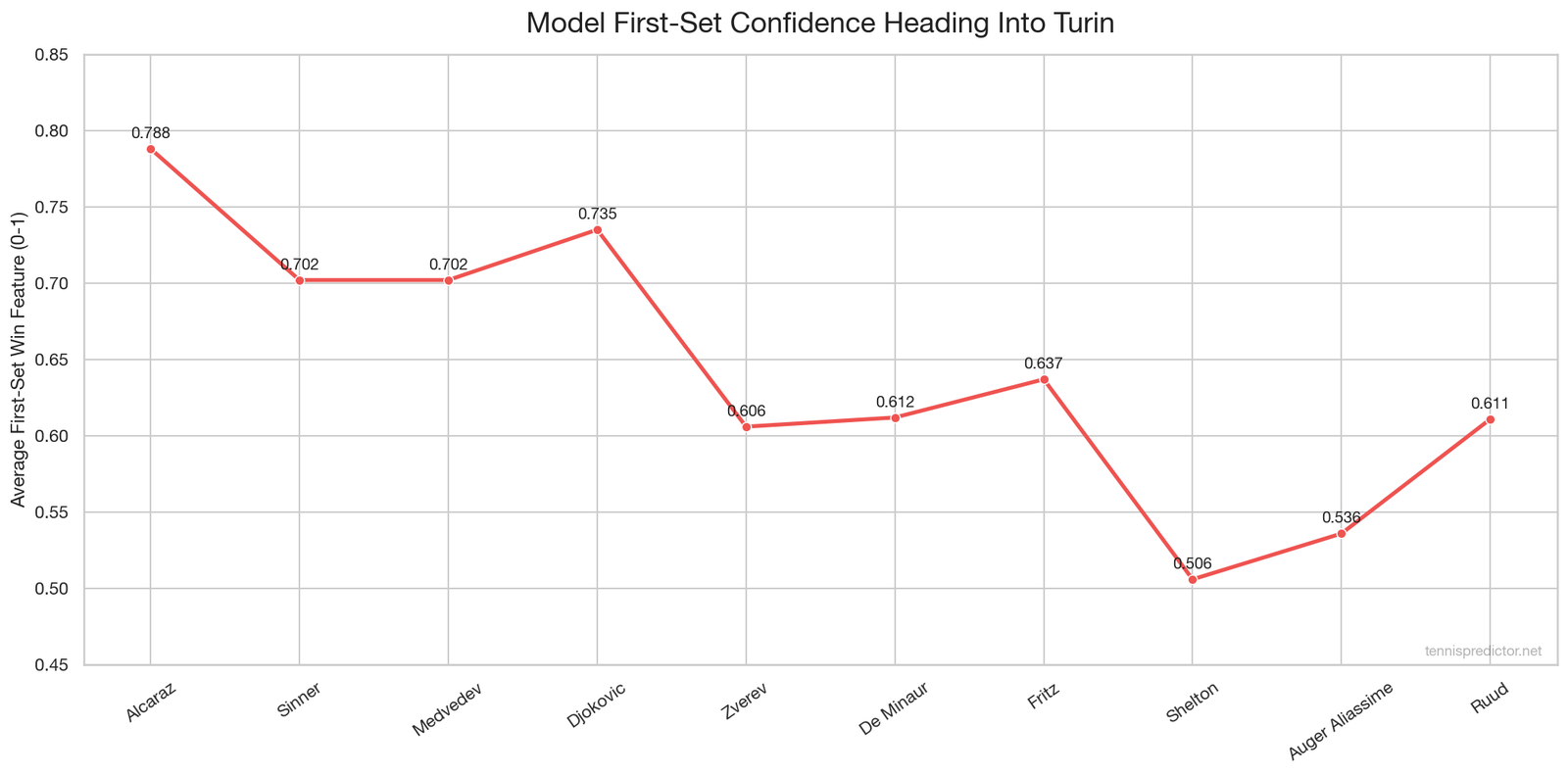

Figure 5: Average model first-set confidence feature (0-1 scale) since 2023.

Figure 5: Average model first-set confidence feature (0-1 scale) since 2023.

Our internal “first-set feature” is a composite signal that blends serve dominance, short-rally win percentage, and historic performance when holding first strike. It is the backbone of the first-set betting model that currently drives 69.5% match winner correlation across the tour.

How to use the first-set data:

- Alcaraz (0.788) and Djokovic (0.735) bring elite first-strike profiles. When they storm through set one, they convert the match over 80% of the time historically.

- Sinner (0.702) sits right behind them, but his risk profile is more front-loaded—when the first set slips away, his indoor comeback rate drops below 35%.

- Shelton (0.506) is the only qualifier under 0.55, reinforcing why he is a high-volatility live-betting target. When he grabs early momentum, lean into the over-performer narrative; when he falls behind, the match often ends quickly.

If you are dabbling in live markets, tie your staking plan to this chart. First sets in Turin often deliver the tempo for the entire match because service holds are harder to disrupt indoors without major returns weapons.

Betting Checklist Before the First Ball

Our recommended workflow for Turin:

- Map the group-stage upset potential first. The 50.0% upset rate in 2022 remains the baseline when the market overprices chalk in flashy opening-night matches.

- Reference top-10 conversion before placing outrights. Anyone below 40% is a “win a group, lose a semi” profile in our simulations.

- Stage your unit sizes around KO rounds. Semis and finals historically favor chalk (66.7% favorite hit rate), so rolling over profitable group-stage spots into the weekend makes more sense than pre-tournament outrights.

- Use first-set signals for live entries. When our first-set model flashes >0.70 and the player nabs the opener, the closing probability jumps above 80%—a huge edge when markets drift toward even money.

Final Word: Aim for Precision, Not Exposure

The ATP Finals amplify everything—the stage, the markets, the variance. That does not mean you have to treat it like a betting festival. Anchor to the numbers above, especially the top-10 conversion and first-set gradients, and lean on live markets instead of pre-tournament long shots. Our dashboard will stream every group probability update once play starts, so set alerts, stay nimble, and let the data cull the noise.

If you want real-time projections during the week, hop into the Predictions dashboard and toggle the “Masters Cup” filters—we will push Turin-specific match probabilities four times per day. See you courtside in the data streams.