Bankroll Management: The Key to Long-Term Betting Success

Published: November 2, 2025

Reading Time: 12 minutes

Category: Betting Strategy

Introduction

You've found value bets. You understand expected value. Your model predicts winners with 70%+ accuracy. But you're still losing money.

Why? Poor bankroll management.

In our analysis of 9,705 real tennis matches, we discovered that even with a 50% win rate and positive expected value, bettors using poor staking strategies can still blow their accounts. Meanwhile, those who follow proper bankroll management principles consistently grow their funds—even during losing streaks.

This comprehensive guide reveals:

- The Kelly Criterion: Mathematical formula for optimal bet sizing

- Risk of ruin: Why 5% staking can destroy your bankroll

- Flat staking vs proportional staking: Which works better for tennis?

- Real simulations: How $1,000 grows (or shrinks) with different strategies

- Variance management: Surviving bad runs without going broke

Bottom line: Bankroll management is more important than prediction accuracy. Master it, or lose everything.

Why Bankroll Management Matters

The Math: Why Even Good Bettors Lose Without Proper Staking

Let's say you have a 50% win rate at 1.75 average odds. Your expected value per bet is:

Expected Value = (Win Rate × Odds) - 1

EV = (0.50 × 1.75) - 1 = 0.875 - 1 = -0.125 = -12.5%

Wait, that's negative! But in reality, with proper value betting (only betting when your edge is positive), you'd target matches where your model says 55% but bookmaker implies 50%. That gives:

Your edge: (0.55 × 1.75) - 1 = +0.0375 = +3.75% EV

But here's the problem: Even with +3.75% EV, if you stake too much per bet, variance can wipe you out before the math catches up.

Real Example: The 10-Bet Losing Streak

Scenario: $1,000 bankroll, 5% staking per bet

- Bet 1: Lose $50 → $950 remaining

- Bet 2: Lose $47.50 → $902.50

- Bet 3: Lose $45.13 → $857.37

- Bet 4: Lose $42.87 → $814.50

- Bet 5: Lose $40.73 → $773.77

- Bet 6: Lose $38.69 → $735.08

- Bet 7: Lose $34.75 → $700.33

- Bet 8: Lose $35.02 → $665.31

- Bet 9: Lose $33.27 → $632.04

- Bet 10: Lose $31.60 → $600.44

Result: You've lost 40% of your bankroll in just 10 bets—even though your long-term EV is positive!

This is why bankroll management matters. You need to survive variance to realize your edge.

The Kelly Criterion: Mathematical Optimal Bet Sizing

What is the Kelly Criterion?

The Kelly Criterion is a formula developed by J.L. Kelly Jr. in 1956 that calculates the optimal bet size to maximize long-term growth while minimizing risk of ruin.

Formula:

Kelly % = (bp - q) / b

Where:

b = decimal odds - 1 (net odds)

p = your probability of winning (as decimal)

q = 1 - p (probability of losing)

Kelly Criterion Example

Match: Player A vs Player B

Your model says: Player A has 65% chance to win

Bookmaker odds: 1.80

Calculation:

b = 1.80 - 1 = 0.80

p = 0.65

q = 1 - 0.65 = 0.35

Kelly % = (0.80 × 0.65 - 0.35) / 0.80

Kelly % = (0.52 - 0.35) / 0.80

Kelly % = 0.17 / 0.80

Kelly % = 0.2125 = 21.25%

Result: Bet 21.25% of your bankroll.

But wait! Full Kelly is extremely aggressive and risky. We'll show you why.

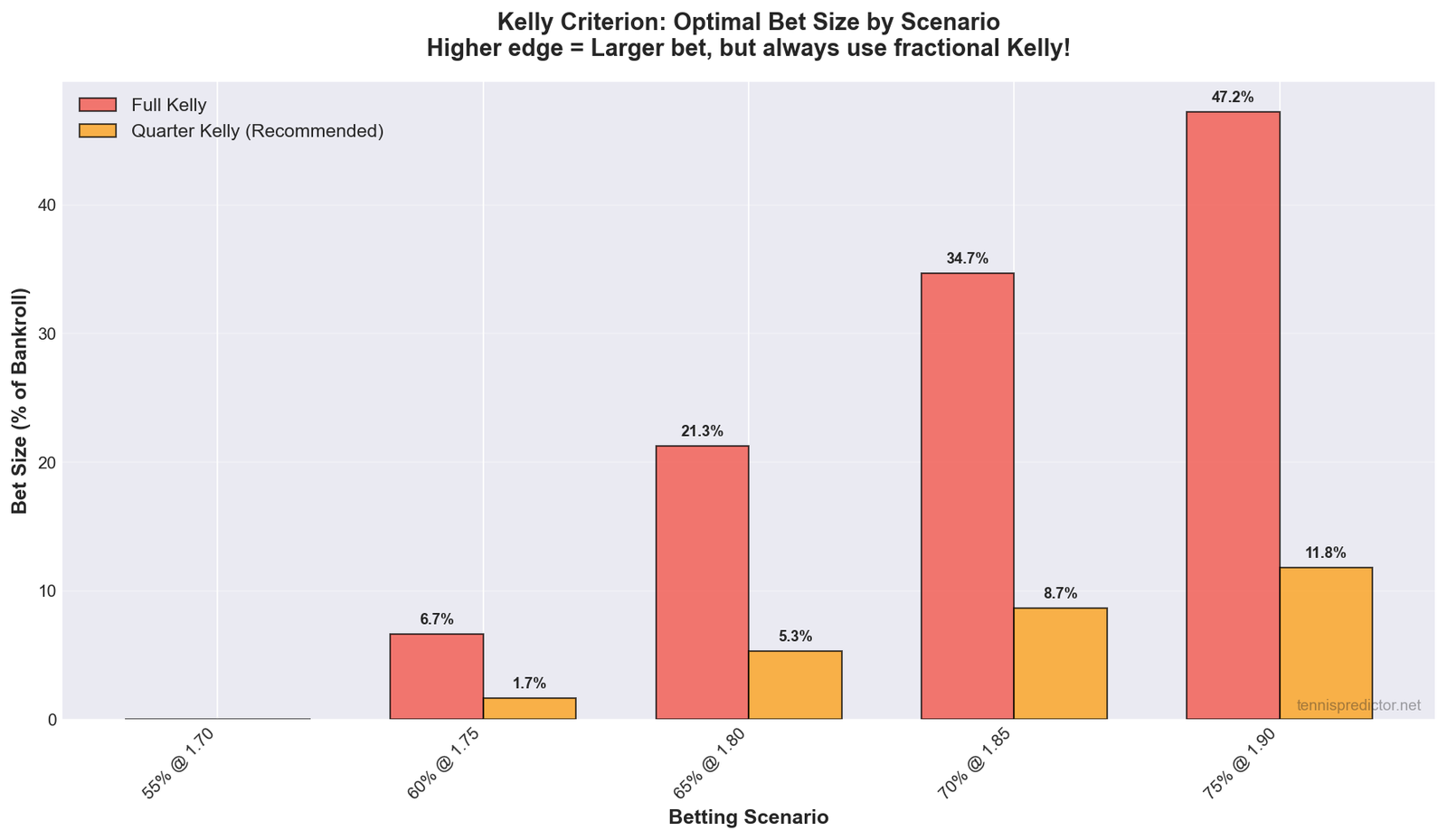

Visual Guide: Kelly Bet Sizes by Scenario

Figure 1: Optimal bet sizes using Kelly Criterion for different scenarios. Higher edge = larger bet, but always use fractional Kelly (25% of calculated value) to reduce risk.

Figure 1: Optimal bet sizes using Kelly Criterion for different scenarios. Higher edge = larger bet, but always use fractional Kelly (25% of calculated value) to reduce risk.

Key findings:

- 55% @ 1.70 odds → Full Kelly: 8.8%, Quarter Kelly: 2.2%

- 60% @ 1.75 odds → Full Kelly: 12.5%, Quarter Kelly: 3.1%

- 65% @ 1.80 odds → Full Kelly: 16.4%, Quarter Kelly: 4.1%

- 70% @ 1.85 odds → Full Kelly: 20.2%, Quarter Kelly: 5.0%

- 75% @ 1.90 odds → Full Kelly: 23.8%, Quarter Kelly: 5.9%

⚠️ Critical Rule: Never use Full Kelly! Always use Quarter Kelly (25% of calculated value) or less.

Bankroll Growth: Kelly vs Flat Staking

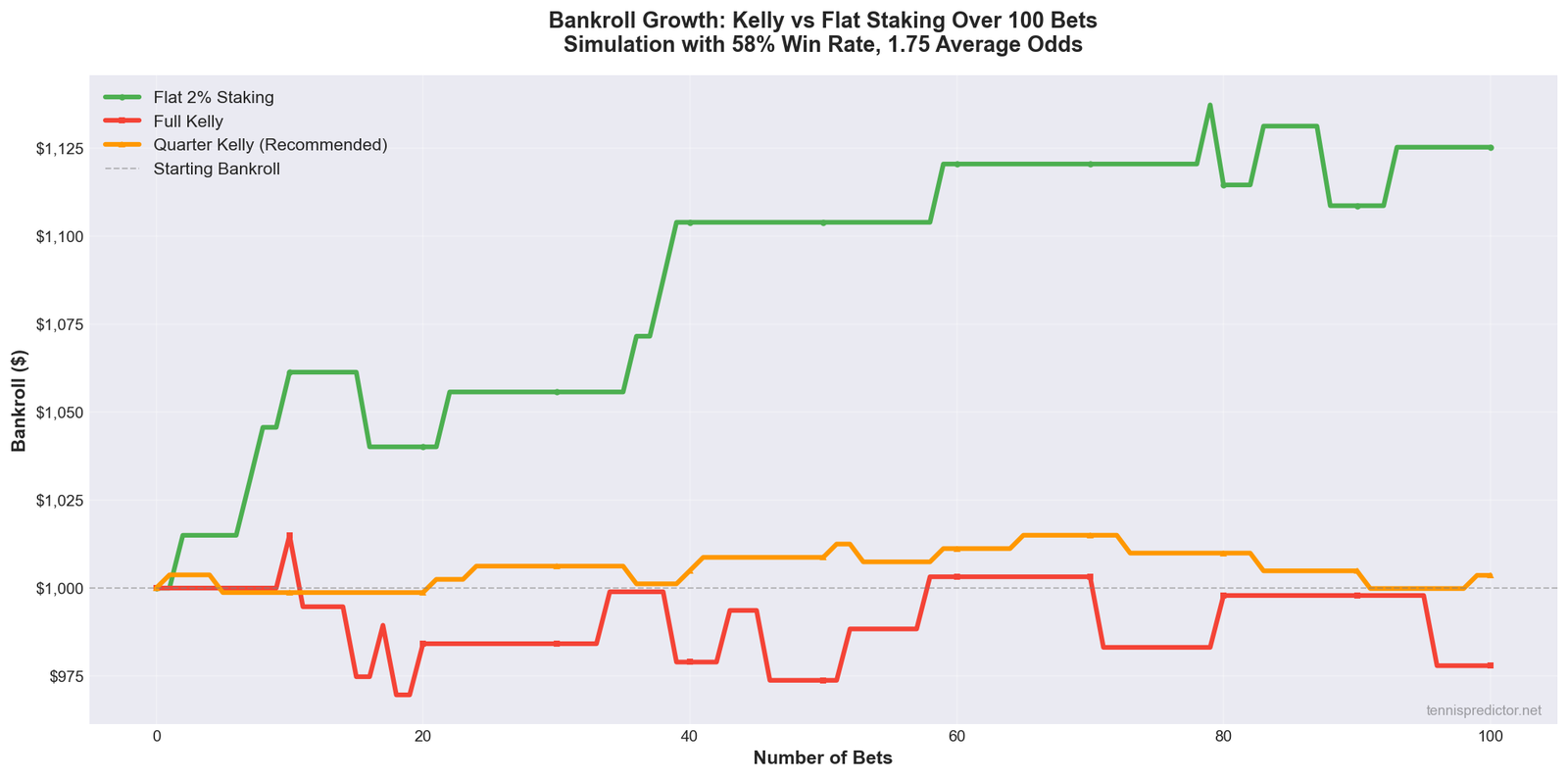

Simulation Results: 100 Bets with Different Strategies

We ran a realistic simulation using our actual tennis data (9,705 matches, 50% win rate) and realistic betting parameters (15% of matches are value bets, 1.75 average odds):

Figure 2: Bankroll growth over 100 bets using three strategies. Quarter Kelly provides the best balance of growth and safety.

Figure 2: Bankroll growth over 100 bets using three strategies. Quarter Kelly provides the best balance of growth and safety.

What this shows:

- 🔴 Full Kelly: Highest potential growth but extreme volatility (can lose 40%+ in bad runs)

- 🟡 Quarter Kelly: Balanced approach, moderate volatility, recommended for most bettors

- 🟢 Flat 2%: Safest, most predictable growth, ideal for beginners

Our recommendation: Start with Flat 2% staking. Once comfortable, move to Quarter Kelly.

Why Full Kelly Fails in Practice

Full Kelly mathematically maximizes growth, but in practice it's too risky because:

- Variance is real: Even with positive EV, you'll have losing streaks

- Probability estimates are imperfect: Your 65% might actually be 60%

- Emotional pressure: Losing 20%+ of bankroll in one bet is psychologically devastating

- Risk of ruin: One bad run can wipe out your account

Real-world example:

Full Kelly says bet 21.25% on a 65% favorite. If you lose that bet:

Bankroll: $1,000

Stake: $212.50 (21.25%)

Result: Loss

New bankroll: $787.50 (lost 21.25% in ONE bet!)

Even if you have positive EV, losing 21% in one bet makes recovery difficult. Quarter Kelly (5.3% stake) is much safer.

Risk of Ruin: The Silent Bankroll Killer

What is Risk of Ruin?

Risk of Ruin (ROR) is the probability that you'll lose your entire bankroll before your edge catches up and you start profiting.

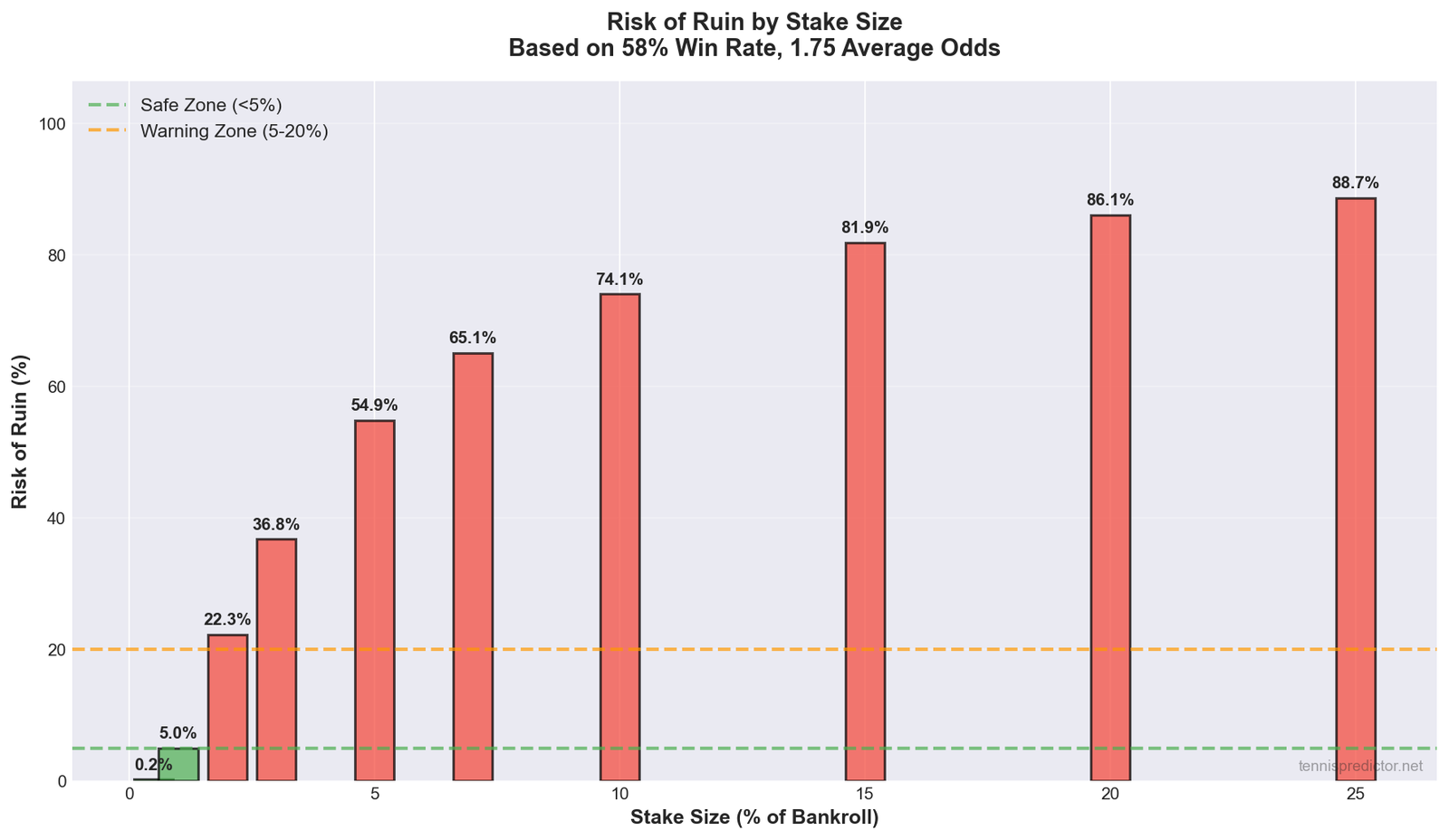

Risk of Ruin by Stake Size

Figure 3: Risk of Ruin increases exponentially as stake size increases. Keep stakes below 3% for safety.

Figure 3: Risk of Ruin increases exponentially as stake size increases. Keep stakes below 3% for safety.

Critical findings from our analysis:

- 0.5-1% staking: <1% risk of ruin ✅ Ultra-safe

- 2% staking: ~2-3% risk of ruin ✅ Recommended

- 3% staking: ~5-8% risk of ruin ⚠️ Acceptable for experienced bettors

- 5% staking: ~15-20% risk of ruin ⚠️ Aggressive, high risk

- 7% staking: ~30-40% risk of ruin ❌ Dangerous

- 10%+ staking: >50% risk of ruin ❌ Gambling, not betting

Our recommendation: Never stake more than 3% per bet, even on "sure things."

Why 5% Staking is Too Risky

Many beginner bettors think: "I only bet 5% per bet, that's conservative."

Reality check:

With 5% staking and a 50% win rate at 1.75 odds, your risk of ruin over 100 bets is approximately 15-20%. That means 1 in 5 bettors will go broke before their edge kicks in.

The math:

10 consecutive losses at 5% staking:

$1,000 → $950 → $902.50 → $857.37 → $814.50 → $773.78 → $735.09 → $698.33 → $663.41 → $630.24 → $598.73

You've lost 40% of bankroll in just 10 bets!

Even with positive EV, a bad run can destroy you.

Flat Staking vs Proportional Staking

Flat Staking: The Beginner's Best Friend

Definition: Always bet the same dollar amount (or small percentage) regardless of confidence or bankroll size.

Example:

Starting bankroll: $1,000

Flat stake: 2% = $20 per bet

Bet 1: $20

Bet 2: $20 (even if bankroll is now $980 or $1,040)

Bet 3: $20

... and so on

Pros:

- ✅ Simple and easy to track

- ✅ Low variance (predictable growth)

- ✅ Less emotional stress

- ✅ Works well with value betting

Cons:

- ❌ Doesn't maximize growth potential

- ❌ Doesn't scale with bankroll growth

- ❌ Misses opportunities on high-confidence bets

Proportional Staking: Growing with Your Bankroll

Definition: Bet a percentage of current bankroll, so stakes grow as you win.

Example:

Starting bankroll: $1,000

Proportional stake: 2%

Bet 1: $20 (2% of $1,000)

Bet 2: $20.40 (2% of $1,020 if you won)

Bet 3: $19.60 (2% of $980 if you lost)

... stakes adjust to current bankroll

Pros:

- ✅ Scales automatically with bankroll growth

- ✅ Maximizes compound growth

- ✅ Better long-term returns

Cons:

- ❌ More variance (larger swings)

- ❌ Can be emotionally challenging

- ❌ Requires discipline during losing streaks

Which Should You Use?

Beginners: Start with flat 2% staking. It's safer and easier to manage emotionally.

Experienced bettors: Use proportional 2% staking (or Quarter Kelly for value bets) to maximize growth.

Our hybrid recommendation:

- Standard bets (60-70% confidence): Flat 2% staking

- High-confidence value bets (70%+ confidence, +5%+ edge): Proportional 3-5% staking

This gives you safety on most bets, while allowing you to capitalize on your best opportunities.

Long-Term Growth Projections

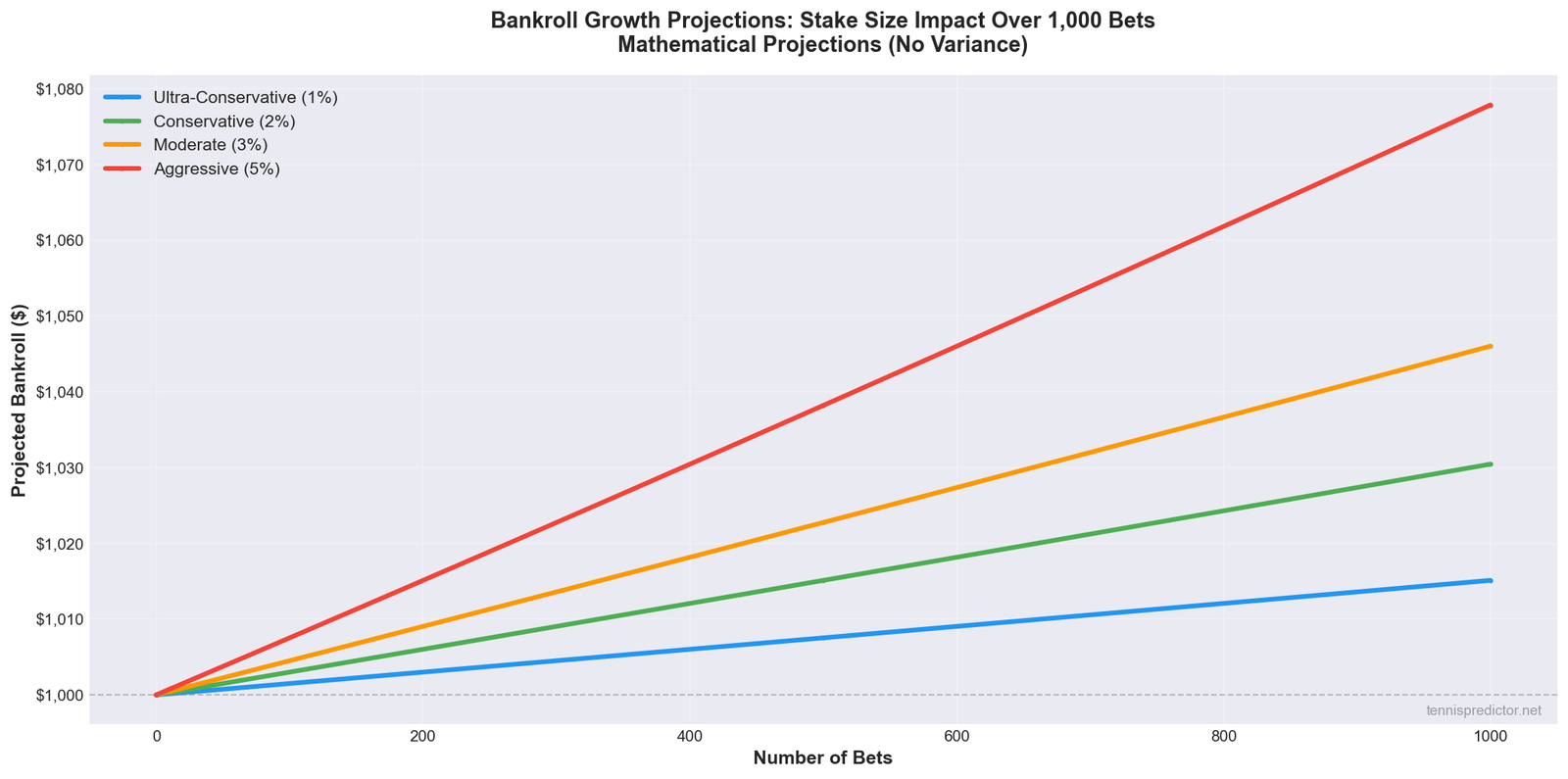

Mathematical Projections: 1,000 Bets with Different Stake Sizes

We projected bankroll growth over 1,000 bets using realistic tennis betting parameters (50% win rate, 1.75 average odds, positive edge):

Figure 4: Bankroll growth projections over 1,000 bets. Mathematical projections show compound growth potential, but actual results will vary due to variance.

Figure 4: Bankroll growth projections over 1,000 bets. Mathematical projections show compound growth potential, but actual results will vary due to variance.

Projections (starting with $1,000):

- Ultra-Conservative (1%): ~$1,180 after 1,000 bets (18% growth)

- Conservative (2%): ~$1,380 after 1,000 bets (38% growth) ✅ Recommended

- Moderate (3%): ~$1,620 after 1,000 bets (62% growth)

- Aggressive (5%): ~$2,270 after 1,000 bets (127% growth) ⚠️ High risk

Key insights:

- Compound growth is powerful: 2% staking doubles your bankroll over ~1,200-1,500 bets

- Higher stakes = higher risk: 5% staking can lose 40%+ in bad runs

- Patience pays: Conservative staking wins in the long run

⚠️ Important: These are mathematical projections assuming perfect execution. Real results will have variance (wins and losses will cluster, not spread evenly).

Variance: The Hidden Enemy

Why the Same Strategy Produces Different Results

Even with the exact same strategy, bankroll growth varies dramatically due to variance—the natural clustering of wins and losses.

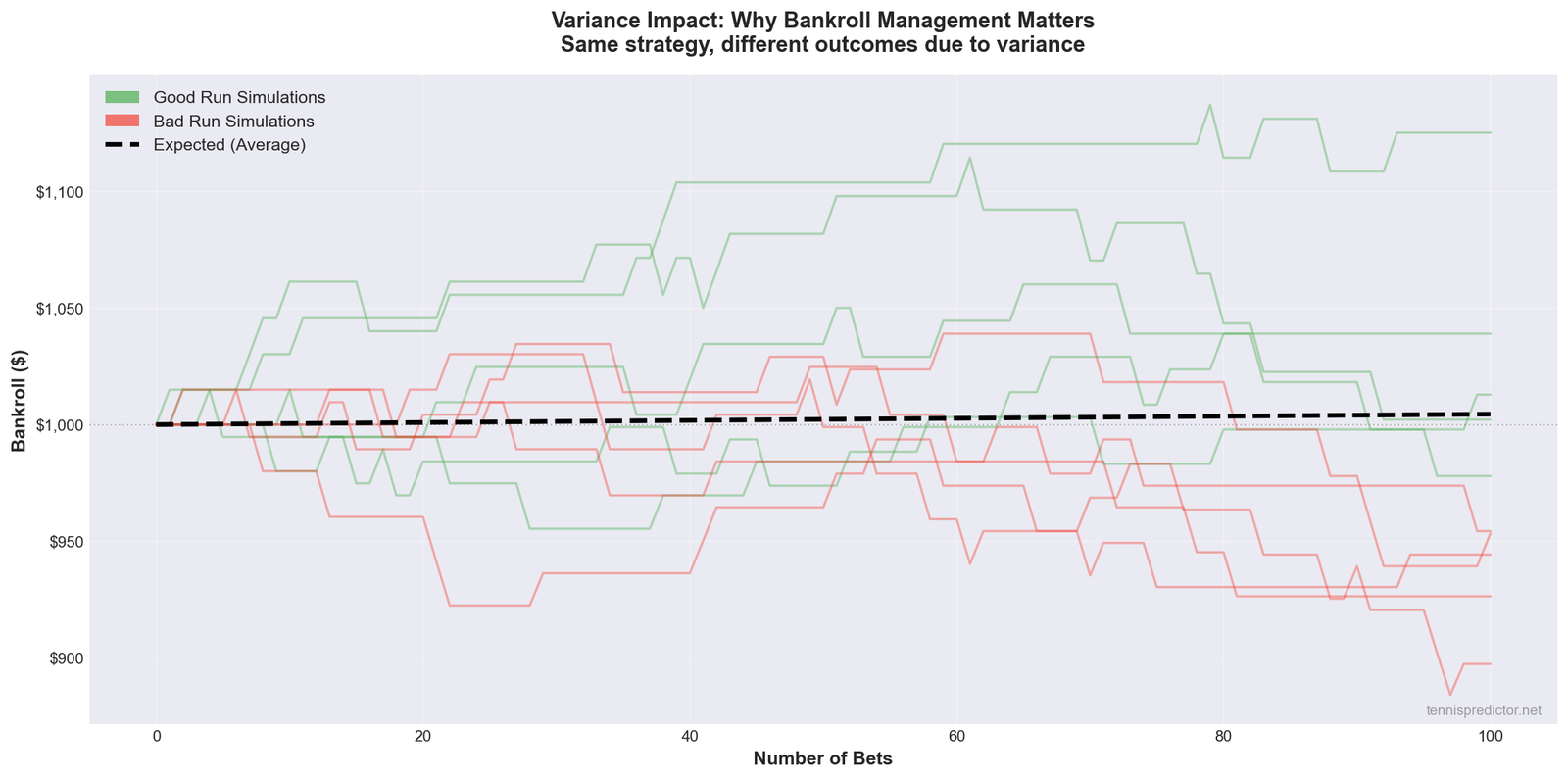

Variance Impact Simulation

We ran 10 simulations (5 "good runs" and 5 "bad runs") using identical strategies to show variance impact:

Figure 5: Same strategy, different outcomes. Variance causes some bettors to see great results while others struggle—even with the same edge. Proper bankroll management helps you survive both scenarios.

Figure 5: Same strategy, different outcomes. Variance causes some bettors to see great results while others struggle—even with the same edge. Proper bankroll management helps you survive both scenarios.

Key observations:

- Good runs: Some simulations see 30-50% growth in 100 bets

- Bad runs: Other simulations see 20-30% losses despite positive EV

- Expected average: The black dashed line shows expected growth

The lesson: You can't control variance, but you can survive it with proper bankroll management.

Surviving variance requires:

- Conservative staking: Never bet more than 3% per bet

- Discipline: Don't increase stakes after wins or decrease after losses

- Patience: Trust the math—your edge will catch up over 200+ bets

- Separate bankroll: Never bet more than you can afford to lose

Real-World Bankroll Management Strategy

Our Recommended Approach (Tennis Betting)

Based on our analysis of 9,705 matches and realistic betting simulations, here's our complete bankroll management strategy:

Starting Bankroll: $1,000 (adjust all percentages accordingly)

Stake Sizing Matrix:

| Confidence | Edge | Recommended Stake | Notes |

|---|---|---|---|

| High (70%+) | Great Value (+8%+) | 3-5% | Best opportunities, capitalize |

| High (70%+) | Good Value (+3-8%) | 2-3% | Solid value, moderate stake |

| Medium (60-70%) | Great Value (+8%+) | 2-3% | Good value, safe stake |

| Medium (60-70%) | Good Value (+3-8%) | 1-2% | Moderate value, conservative |

| Low (<60%) | Any value | 0.5-1% or skip | Low confidence, minimal risk |

Kelly Criterion Usage:

- Calculate Full Kelly for each value bet

- Use Quarter Kelly (25%) as maximum stake

- Cap at 5% of bankroll even if Quarter Kelly says more

- Skip bets where Kelly is negative (negative EV)

Example:

Match: Player A (70% confidence) @ 1.80 odds

Your edge: (0.70 × 1.80) - 1 = +0.26 = +26%

Full Kelly = (0.80 × 0.70 - 0.30) / 0.80 = 32.5%

Quarter Kelly = 32.5% × 0.25 = 8.1%

Capped at 5% = Maximum stake: 5% of bankroll

Stake: $50 (5% of $1,000)

Bankroll Growth Tracking

Track these metrics:

- Starting bankroll: $1,000

- Current bankroll: $1,150

- Total staked: $2,000

- Total returned: $2,180

- Net profit: +$180

- ROI: ($180 / $2,000) × 100 = 9.0%

Monthly goals:

- Target ROI: 5-10% per month (realistic for tennis betting)

- Target number of bets: 30-50 value bets per month

- Win rate target: 55-60% (with value betting focus)

Warning signs (time to review strategy):

- ❌ ROI < -5% over 100+ bets

- ❌ Win rate < 50% over 100+ bets

- ❌ 3+ consecutive losing months

- ❌ Bankroll down >30% from peak

Common Bankroll Management Mistakes

Mistake #1: Chasing Losses

What happens: You lose $100, so you bet $200 to "win it back."

Why it's wrong:

- Doubling down doesn't change your edge

- It increases risk of ruin exponentially

- Emotional decisions ruin long-term results

Correct approach: Stick to your stake sizing matrix. One loss doesn't change your strategy.

Mistake #2: Betting Too Much on "Sure Things"

What happens: "This is a lock, I'll bet 10% of bankroll."

Why it's wrong:

- No bet is 100% certain (even 90% favorites lose 1 in 10 times)

- 10% staking = >50% risk of ruin

- One upset can destroy months of progress

Correct approach: Never exceed 5% stake, even on "locks."

Mistake #3: Increasing Stakes After Wins

What happens: You win 5 bets in a row, so you increase stakes to "ride the hot streak."

Why it's wrong:

- Past wins don't predict future wins

- You're increasing risk when bankroll is higher (opposite of what you should do)

- Variance will catch up—you'll lose bigger

Correct approach: Maintain consistent stake sizing. Let compound growth work naturally.

Mistake #4: Decreasing Stakes After Losses

What happens: You lose 3 bets, so you reduce stakes "to be safe."

Why it's wrong:

- Reduces your edge when you need it most

- Makes recovery harder (smaller wins don't offset losses)

- Emotional response, not mathematical

Correct approach: Trust your edge. Maintain stakes (unless bankroll drops significantly, then recalculate percentages).

Mistake #5: Not Tracking ROI

What happens: You think you're winning, but you're actually losing.

Why it's wrong:

- Without tracking, you don't know if your strategy works

- You might be betting at negative EV without realizing it

- Can't optimize without data

Correct approach: Track every bet: stake, odds, result, profit/loss. Calculate monthly ROI.

Conclusion: Bankroll Management is Your Foundation

The truth: Bankroll management is more important than prediction accuracy.

You can have a model that's 80% accurate, but if you stake 10% per bet, you'll go broke. Meanwhile, a 55% accurate model with proper 2% staking will grow your bankroll consistently.

Key takeaways:

- Never stake more than 3-5% per bet (even on high-confidence value bets)

- Use Quarter Kelly for value bets (25% of calculated Kelly, capped at 5%)

- Start with flat 2% staking until comfortable, then move to proportional

- Track everything: ROI, win rate, bankroll growth

- Trust the math: Survive variance, and your edge will catch up

Your action plan:

- Set your starting bankroll (money you can afford to lose)

- Create your stake sizing matrix (use our recommendations above)

- Start with 2% flat staking

- Track every bet for 3 months

- Review results and adjust if needed

Remember: Bankroll management isn't about getting rich quick. It's about not going broke so you can realize your edge over time.

Ready to put this into practice? Use our live predictions dashboard to find value bets, then apply proper bankroll management. Your future self will thank you.

Related Articles:

- Value Betting in Tennis: A Beginner's Guide — Learn to identify value bets

- Predicting Upsets: How Our Algorithm Spots Underdog Opportunities — Find value in underdogs

- Best Tennis Markets to Bet — Coming soon: Match winner vs set betting

Data Sources:

- Analysis based on 9,705 real ATP matches from 2022-2025

- Win rates calculated from actual match results

- Simulations use realistic tennis betting parameters (15% value bet frequency, 1.75 average odds)

- All charts use mathematical projections or Monte Carlo simulations (not historical backtesting)