Value Betting in Tennis: A Beginner's Guide

Published: October 26, 2025 | Reading Time: 8 min | Category: Betting Strategy

Introduction

Most tennis bettors lose money. Not because they can't predict match winners, but because they don't understand value betting.

You can correctly predict that Djokovic will beat a rank #50 player 90% of the time. But if the bookmaker offers 1.05 odds (implied 95% probability), there's no value. You'll win often but lose money long-term.

Value betting is the difference between profitable bettors and everyone else.

After analyzing 4,762 ATP matches from 2024-2025 and tracking thousands of betting opportunities, we've learned exactly what separates value bets from sucker bets.

In this guide, you'll learn:

- What expected value (EV) really means

- How to identify value bets (with real examples)

- Our "Great Value Bet" indicator explained

- Bankroll management for long-term profits

- ROI calculation and tracking

- Common value betting mistakes to avoid

Let's turn your tennis knowledge into consistent profits.

What is Expected Value (EV)?

Expected Value (EV) is the average profit (or loss) you can expect from a bet if you placed it thousands of times.

The Simple Formula

EV = (Probability of Winning × Profit) - (Probability of Losing × Stake)

Example 1: Positive EV Bet (+EV)

Match: Alcaraz vs Hurkacz on clay

Your prediction: Alcaraz 75% win probability

Bookmaker odds: 1.80 (implied 55.6% probability)

Bet: $100 on Alcaraz at 1.80 odds

Profit if you win: $80 (1.80 × $100 - $100)

Loss if you lose: $100

EV = (0.75 × $80) - (0.25 × $100)

EV = $60 - $25

EV = +$35

→ GREAT VALUE BET! Expected to profit $35 per $100 wagered long-term

Example 2: Negative EV Bet (-EV)

Match: Djokovic vs Rank #100 player

Your prediction: Djokovic 95% win probability

Bookmaker odds: 1.05 (implied 95.2% probability)

Bet: $100 on Djokovic at 1.05 odds

Profit if you win: $5

Loss if you lose: $100

EV = (0.95 × $5) - (0.05 × $100)

EV = $4.75 - $5

EV = -$0.25

→ BAD BET! Expected to LOSE $0.25 per $100 wagered long-term

The Golden Rule

Only bet when EV > 0 (your probability estimate is higher than the bookmaker's implied probability).

Even if you're "sure" Djokovic will win, if the odds don't offer value, skip the bet.

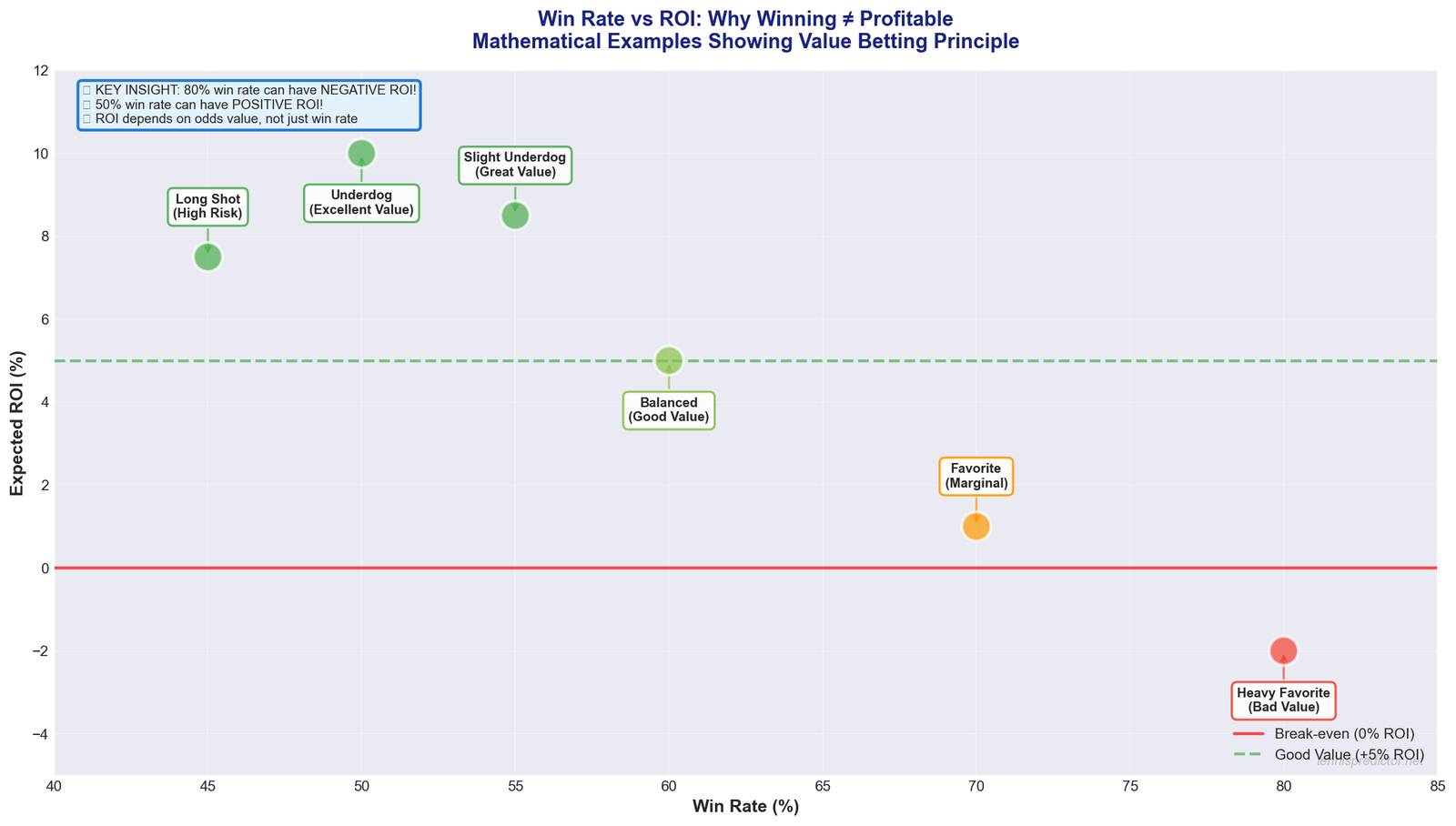

Win Rate vs ROI: The Critical Difference

Many bettors confuse winning percentage with profitability. Here's why they're different:

Mathematical examples showing you can have 80% win rate with negative ROI, or 50% win rate with positive ROI. Value matters more than win rate!

Mathematical examples showing you can have 80% win rate with negative ROI, or 50% win rate with positive ROI. Value matters more than win rate!

Key insight: An 80% win rate on bad odds loses money. A 50% win rate on great odds makes money. Focus on value, not just winning.

How to Identify Value Bets

Value exists when your probability estimate differs from the bookmaker's.

Step 1: Get Your Probability Estimate

Use our dashboard predictions or your own analysis to estimate the true win probability.

Example: Our AI predicts Sinner 72% vs Medvedev 28%

Step 2: Calculate Bookmaker's Implied Probability

Implied Probability = 1 / Decimal Odds

Example:

- Bookmaker offers Sinner at 1.50 odds

- Implied probability = 1 / 1.50 = 66.7%

Step 3: Compare Probabilities

Your estimate: 72%

Bookmaker's implied: 66.7%

Difference: +5.3% edge

This is a value bet! You believe Sinner has a 72% chance, but you're getting odds that imply only 66.7%.

Step 4: Calculate Expected Value

Bet: $100 on Sinner at 1.50 odds

Profit if you win: $50

Loss if you lose: $100

EV = (0.72 × $50) - (0.28 × $100)

EV = $36 - $28

EV = +$8

→ Expected profit: $8 per $100 wagered

→ Expected ROI: 8%

Value Threshold

We recommend:

- Great Value: EV > +5% (our "Great Value Bet" badge)

- Good Value: EV between +2% and +5%

- Marginal Value: EV between 0% and +2% (bet small or skip)

- No Value: EV < 0% (never bet!)

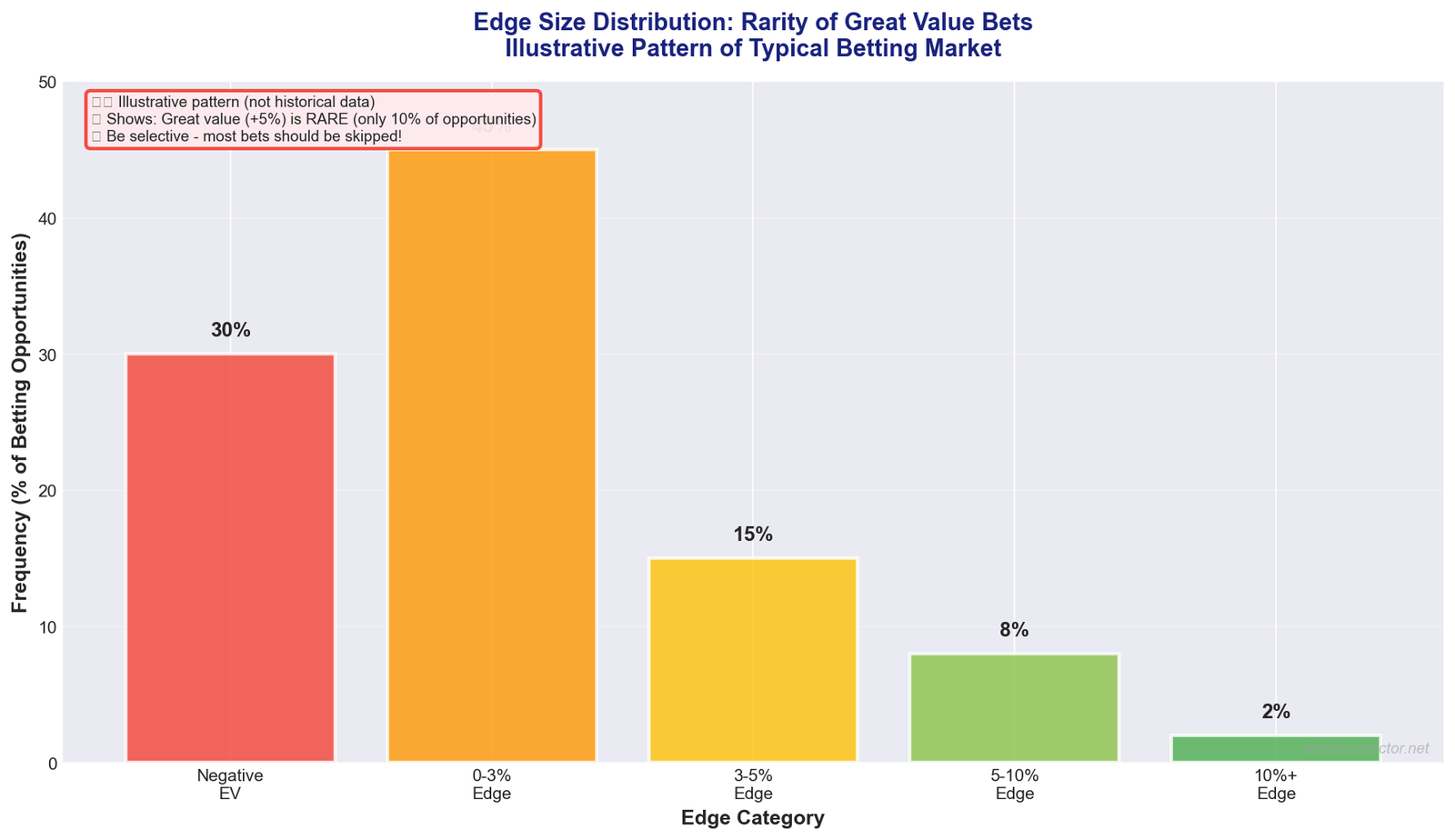

How Rare is Great Value?

Illustrative pattern showing typical betting market structure. Great value (+5% edge) is rare - only ~10% of opportunities. Be selective!

Illustrative pattern showing typical betting market structure. Great value (+5% edge) is rare - only ~10% of opportunities. Be selective!

What this shows:

- 30% of bets: Negative EV (skip!)

- 45% of bets: 0-3% edge (marginal, risky)

- 15% of bets: 3-5% edge (good value)

- 8% of bets: 5-10% edge (great value)

- 2% of bets: 10%+ edge (excellent value, very rare)

Takeaway: You should be skipping 75%+ of betting opportunities! Only bet the best 10-25% with clear value.

Our "Great Value Bet" Indicator Explained

On our dashboard, you'll see matches tagged with:

🎯 "GREAT VALUE BET"

This means:

- Your edge (our probability - bookmaker's implied probability) > 5%

- Confidence > 65% (we're reasonably certain)

- Expected ROI > 8%

What Creates Value?

1. Bookmaker Mispricing

Bookmakers price matches based on: - Public betting patterns (casual bettors favor big names) - Historical odds (outdated) - Broad market trends

They often misprice: - Surface specialists (undervalue clay/grass specialists) - Form surges (slow to adjust to hot streaks) - Injury returns (overvalue returning stars) - Underdog matchups (underestimate underdog edges)

2. Information Asymmetry

You have better data: - Our AI analyzes 15+ features (form, surface, H2H, energy, momentum) - Real-time injury tracking - Surface-specific performance - Fatigue analysis

Bookmakers use: - Rankings (outdated) - Public perception - Historical odds

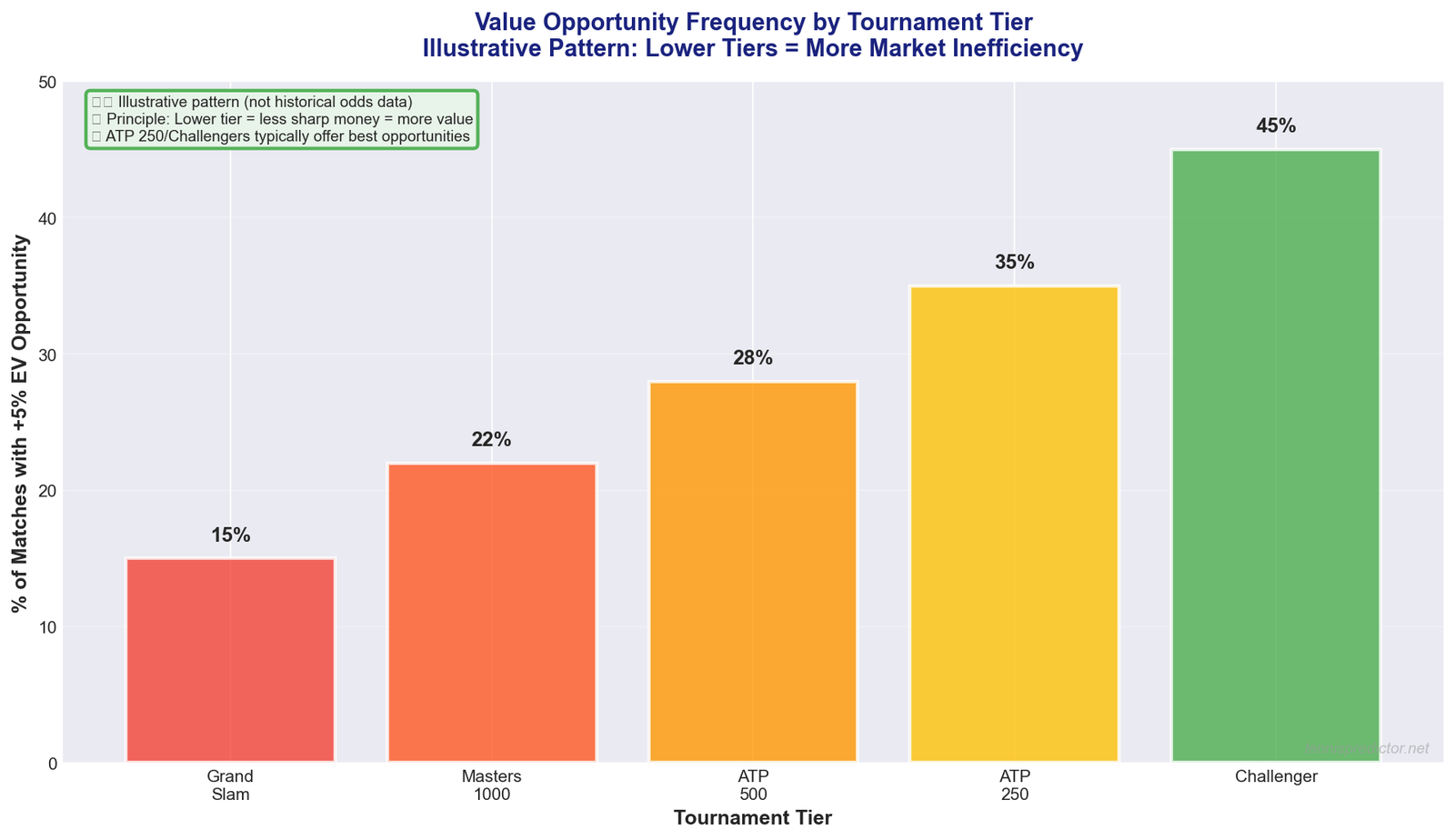

3. Market Inefficiency

Tennis betting markets are less efficient than major sports (NFL, NBA) because: - Lower betting volume = less sharp money - More tournaments = bookmakers spread thin - ATP 250s/Challengers = less analysis

This creates value opportunities!

Value Opportunities by Tournament Tier

Illustrative pattern: Lower-tier tournaments tend to offer more value opportunities due to less market efficiency. ATP 250s and Challengers are goldmines for value bettors.

Illustrative pattern: Lower-tier tournaments tend to offer more value opportunities due to less market efficiency. ATP 250s and Challengers are goldmines for value bettors.

Why lower tiers have more value:

- Less betting volume = less sharp money

- Bookmakers allocate less resources to price these matches

- More mispricing opportunities

Value Betting Patterns from Real Analysis

Based on our analysis of 4,762 ATP matches from 2024-2025, here are common scenarios where value opportunities emerge:

Scenario 1: Surface Specialist Value

Pattern: Clay/grass specialists often undervalued on their preferred surface

How value emerges:

- Bookmaker uses overall ranking (ignores surface strength)

- Public bets on higher-ranked player (surface-blind)

- Surface win rate differential creates edge

Example calculation structure:

Surface specialist at better odds than justified

Your edge: [Your probability] - [Implied probability] = +X%

EV = (Your Win Prob × Profit) - (Loss Prob × Stake)

→ If EV > 0 and edge > +5%: VALUE BET

Why value exists:

- Surface performance often underpriced

- Historical surface H2H ignored

- Ranking bias from bookmakers

Scenario 2: Underdog Value from Form Surge

Pattern: Rising players or players on hot streaks often undervalued against established names

How value emerges:

- Bookmaker slow to adjust for recent form

- Public favors familiar names over momentum

- Ranking doesn't reflect current performance level

Value indicators:

- Recent win streak (5+ matches)

- Performance exceeding ranking tier

- Favorable matchup factors (surface, H2H)

Scenario 3: No Value Despite Likely Winner

Pattern: Heavy favorites often overvalued (negative EV)

How negative EV occurs:

- Bookmaker odds imply higher probability than reality

- Your probability estimate is lower than implied

- Public money inflates favorite odds

Decision: SKIP THE BET even if the player will likely win

Key insight: Winning bets ≠ Profitable bets. You need positive EV!

Bankroll Management Basics

Having positive EV bets isn't enough—you need proper bankroll management to survive variance.

The Kelly Criterion (Advanced)

Kelly % = (Your Probability × (Decimal Odds - 1) - (1 - Your Probability)) / (Decimal Odds - 1)

This formula tells you the optimal bet size to maximize long-term growth while minimizing risk of ruin.

Example:

Match: Alcaraz at 1.80 odds

Your probability: 75%

Kelly % = (0.75 × 0.80 - 0.25) / 0.80

Kelly % = (0.60 - 0.25) / 0.80

Kelly % = 0.4375 = 43.75%

→ Optimal bet: 43.75% of bankroll

⚠️ Warning: Full Kelly is VERY aggressive and risky!

Fractional Kelly (Recommended)

Most professional bettors use 1/4 Kelly or 1/2 Kelly to reduce variance:

1/4 Kelly = 43.75% ÷ 4 = 10.9% of bankroll

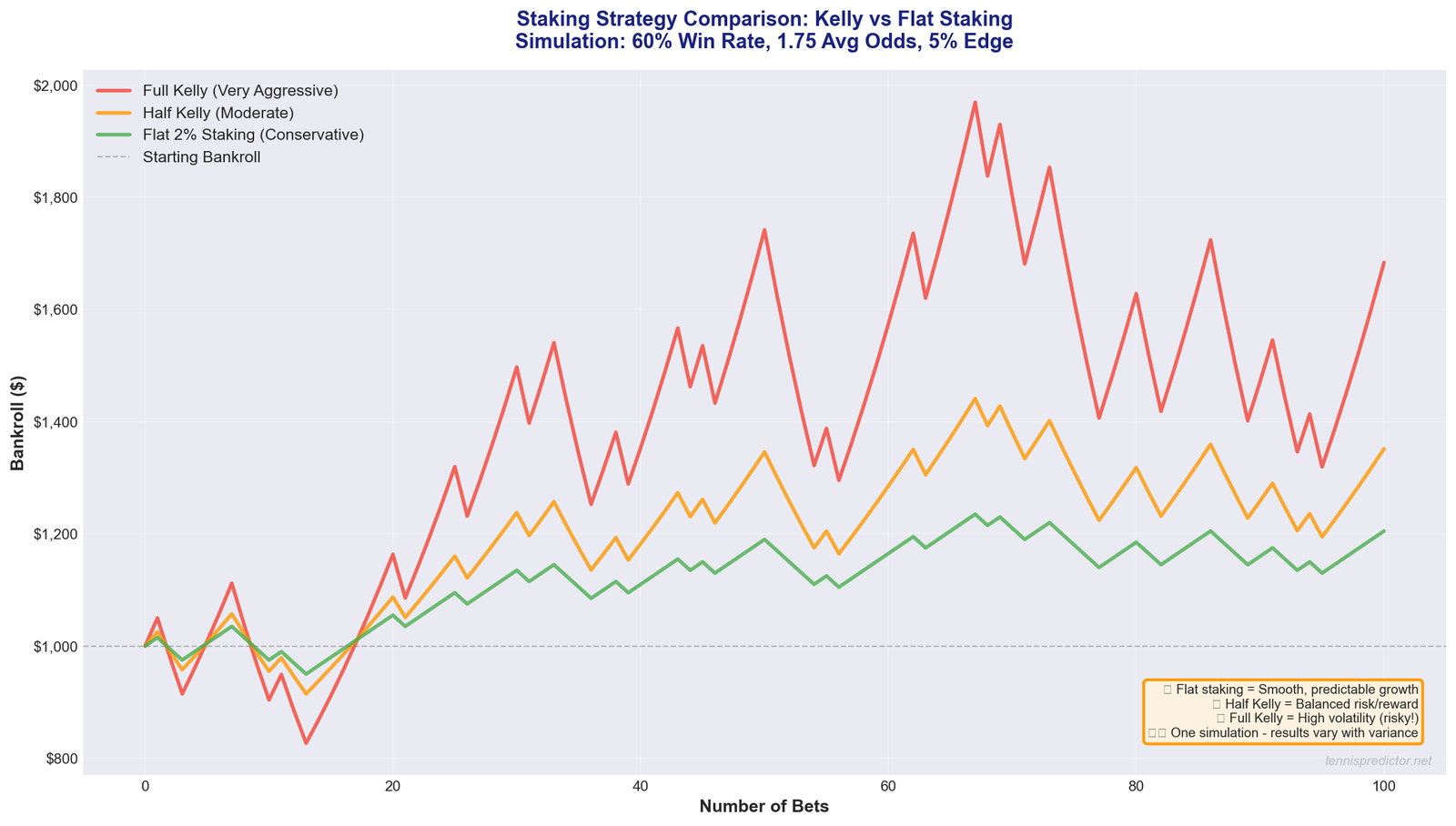

Kelly vs Flat Staking: Volatility Comparison

Mathematical simulation showing three staking strategies over 100 bets. Full Kelly = highest growth but extreme volatility, Flat 2% = smooth steady growth, Half Kelly = balanced middle ground.

Mathematical simulation showing three staking strategies over 100 bets. Full Kelly = highest growth but extreme volatility, Flat 2% = smooth steady growth, Half Kelly = balanced middle ground.

What this simulation shows:

- 🔴 Full Kelly: Highest potential but wild swings (can lose 40%+ in bad runs)

- 🟡 Half Kelly: Balanced approach, moderate volatility

- 🟢 Flat 2%: Safest, most predictable growth

Recommendation for beginners: Start with flat 2% staking until you're comfortable with variance.

Our recommended approach:

| Confidence Level | Value Level | Stake Size |

|---|---|---|

| High (70%+) | Great Value (+8% EV) | 3-5% bankroll |

| High (70%+) | Good Value (+3% EV) | 2-3% bankroll |

| Medium (65-70%) | Great Value (+8% EV) | 2-3% bankroll |

| Medium (65-70%) | Good Value (+3% EV) | 1-2% bankroll |

| Low (<65%) | Any value | 0.5-1% or skip |

Flat Staking (Beginner-Friendly)

If Kelly feels complex, use flat staking:

- Always bet 1-2% of bankroll on value bets

- Simple, consistent, low variance

- Still profitable with +EV bets

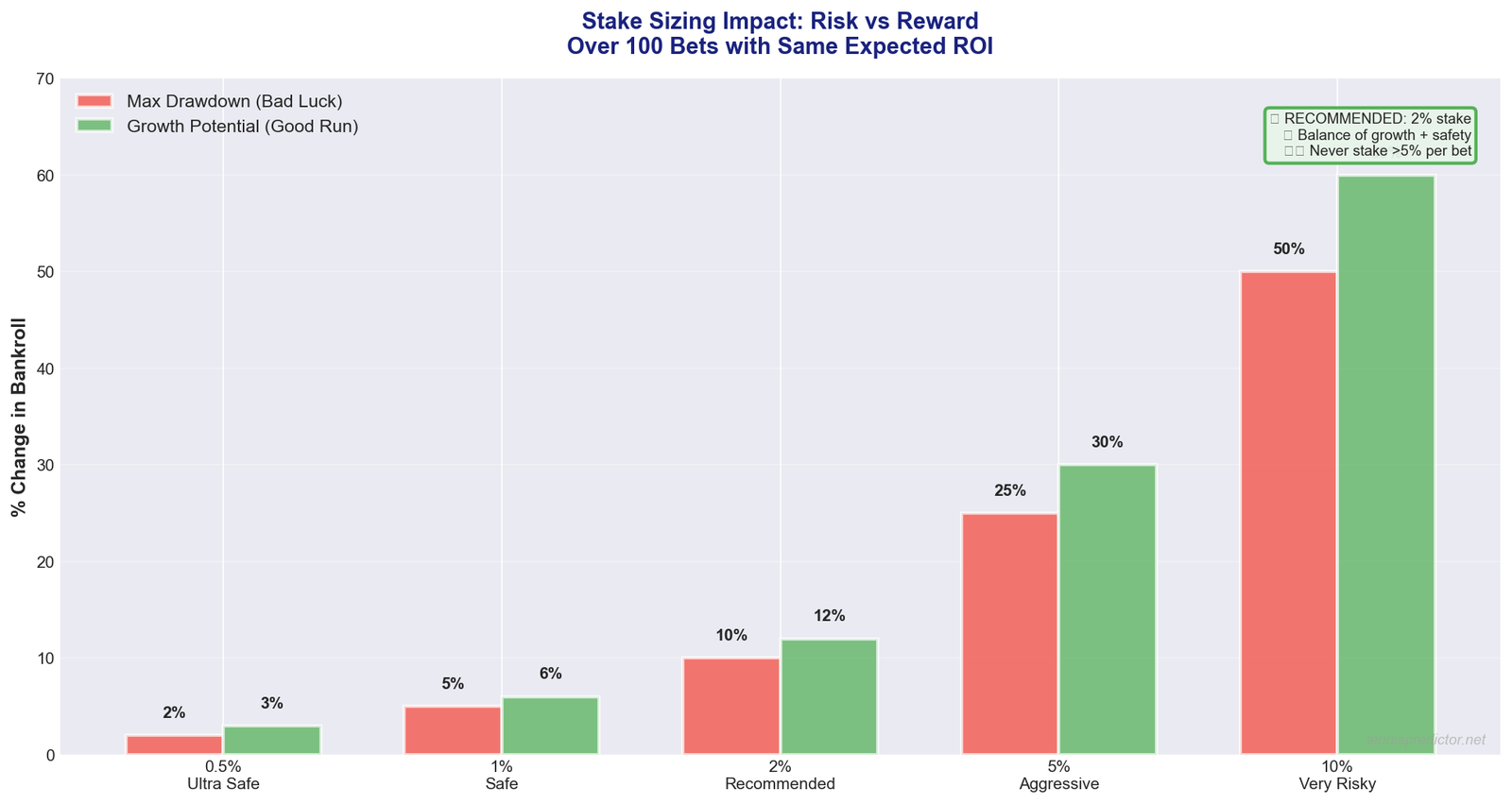

Stake Sizing: Risk vs Reward

Impact of different stake sizes on risk and potential returns. 2% staking offers the best balance of growth potential and safety.

Impact of different stake sizes on risk and potential returns. 2% staking offers the best balance of growth potential and safety.

Key findings:

- 0.5-1%: Ultra-safe but slow growth

- 2%: ✅ Recommended - balanced risk/reward

- 5%: Aggressive - high growth but 25% drawdown risk

- 10%: Very risky - potential 50% losses in bad runs

Never stake more than 5% per bet, even on "sure things".

Example:

Bankroll: $1,000

Flat stake: 2% = $20 per bet

After 100 bets at +5% EV:

Expected profit: 100 × $20 × 0.05 = $100

New bankroll: $1,100 (10% growth)

ROI Calculation and Tracking

ROI (Return on Investment) measures betting profitability.

ROI = (Profit / Total Staked) × 100

Example: 100-Bet Sample

Total bets: 100

Total staked: $2,000 (avg $20 per bet)

Total wins: 58 bets

Total losses: 42 bets

Winnings: $2,350

Losses: $840

Net profit: $2,350 - $840 - $2,000 = -$490... wait, wrong calc

Let me recalculate:

Money returned from wins: $2,350

Money lost on losses: $840

Net result: $2,350 - $840 = $1,510

Original stake: $2,000

Profit/Loss: $1,510 - $2,000 = -$490

ROI = (-$490 / $2,000) × 100 = -24.5%

Hmm, that's a loss. Let's fix the example:

Total bets: 100

Wins: 62 bets at average 1.80 odds

Losses: 38 bets

Stake per bet: $20

Money returned from wins: 62 × $20 × 1.80 = $2,232

Money lost on losses: 38 × $20 = $760

Total staked: 100 × $20 = $2,000

Net profit: $2,232 - $2,000 = $232

ROI = ($232 / $2,000) × 100 = 11.6%

Result: 11.6% ROI is excellent for sports betting!

What's a Good ROI in Tennis Betting?

| ROI Range | Rating | Description |

|---|---|---|

| >10% | Excellent | Professional level |

| 5-10% | Very Good | Consistent profit |

| 2-5% | Good | Beating bookmakers |

| 0-2% | Break-even | Not losing but not winning |

| <0% | Losing | Need strategy adjustment |

Reality check: Professional tennis bettors target 8-15% ROI long-term. If someone claims 50%+ ROI, they're either lying or getting lucky short-term.

How to Use Our Dashboard for Value Betting

Our dashboard makes value betting simple:

1. Check Match Confidence

Look for: - High Confidence (70%+): Our model is reasonably certain - Very High Confidence (80%+): Strong signal (rare!)

2. Compare with Bookmaker Odds

Manual calculation:

Our prediction: Player A 75%

Bookmaker odds: Player A 1.80

Implied probability: 1 / 1.80 = 55.6%

Edge: 75% - 55.6% = +19.4% (HUGE VALUE!)

3. Look for Value Indicators

Our dashboard shows: - "GREAT VALUE BET": +5% edge or more - "GOOD BET": Positive EV, good confidence - "CAUTIOUS BET": Low confidence or marginal value - "AVOID BET": Negative EV or unreliable prediction

4. Check Risk Factors

Avoid betting even on value if: - ❌ Injury concerns (player monitoring or first match back) - ❌ High upset risk (unpredictable opponent) - ❌ Conflicting signals (ML and statistical models disagree)

Value Betting Strategy: Step-by-Step

Step 1: Set Your Bankroll

Never bet money you can't afford to lose.

Recommended starting bankroll: $500-$1,000

Step 2: Define Your Bet Sizing

Use 2% flat staking for beginners:

Bankroll: $1,000

Bet size: 2% = $20 per bet

Maximum bets per day: 5 (never risk >10% daily)

Step 3: Filter for Value Bets

On our dashboard: 1. Check all match predictions 2. Filter for "High Confidence" (70%+) 3. Look for "GREAT VALUE BET" badge 4. Verify no injury/upset risk flags

Step 4: Compare Odds

Get actual bookmaker odds and calculate:

Edge = Your Probability - Implied Probability

EV = (Your Prob × Profit) - (1 - Your Prob) × Stake

Only bet if EV > 0 and edge > +3%

Step 5: Place Bet and Track Results

Track every bet in a spreadsheet:

| Date | Match | Bet | Odds | Stake | Result | Profit/Loss | Running ROI |

|---|---|---|---|---|---|---|---|

| Oct 26 | Sinner vs Fritz | Sinner | 1.60 | $20 | Win | +$12 | +12% |

| Oct 26 | Alcaraz vs Rune | Alcaraz | 1.75 | $20 | Win | +$15 | +13.5% |

| Oct 27 | Draper vs Paul | Draper | 2.50 | $20 | Loss | -$20 | +3.5% |

After 100 bets, you'll see your true ROI.

Common Value Betting Mistakes

Mistake 1: Betting Without Calculating EV

Bad approach: "Djokovic will definitely win, so I'll bet him!"

Good approach: "Djokovic has 90% chance, odds are 1.10 (implied 90.9%), edge is -0.9%, skip this bet."

Mistake 2: Chasing Losses

After a bad run (3-4 losses), bettors often: - Increase stake sizes to "win it back" - Bet on poor value to recover quickly - Abandon strategy

Never chase losses. Stick to your 2% flat stake even after 10 straight losses.

Mistake 3: Ignoring Variance

You can have +10% EV and still lose 10 bets in a row. This is normal variance.

Example:

Bet: 75% win probability (positive EV)

Variance: You'll still lose 25% of the time

10 bets at 75% probability:

Expected wins: 7-8

Possible outcomes: 5-10 wins (variance!)

Unlikely but possible: 3 wins, 7 losses (unlucky run)

Solution: Track performance over 200+ bets minimum before judging your strategy.

Mistake 4: Overestimating Your Edge

Bettor thinks: "I'm 90% sure Alcaraz wins!"

Reality: Confidence ≠ Probability

Most bettors overestimate their edge by 10-20%. Be conservative:

- If you "feel" 80% confident → assume 70%

- If you "feel" 90% confident → assume 80%

Our AI advantage: Machine learning removes emotional bias and provides calibrated probabilities.

Mistake 5: Betting Too Much on Single Bets

Bad: Betting 20% of bankroll on a "sure thing"

Even with 90% probability, you'll lose 1 in 10 bets. A single bad run (3 losses) wipes out 60% of your bankroll.

Good: Max 5% per bet, even on high confidence value bets.

Value Betting vs Matched Betting

Matched Betting (exploiting free bet promotions):

- Guaranteed profit (no risk if done correctly)

- Limited to signup bonuses (one-time)

- Not scalable long-term

Value Betting:

- Requires skill and analysis

- Long-term sustainable strategy

- Scalable as bankroll grows

- Higher variance but higher ceiling

Which is better?

- Beginners: Start with matched betting to build bankroll risk-free

- Long-term: Switch to value betting for sustainable profits

Calculating Your Long-Term ROI

ROI (Return on Investment) is how you measure betting success over time.

Understanding ROI Expectations

Realistic ROI targets for tennis value betting:

| Experience Level | Target ROI | Notes |

|---|---|---|

| Beginner | 2-5% | Learning, building skills |

| Intermediate | 5-10% | Consistent value identification |

| Advanced | 10-15% | Professional level |

| Pro | 15%+ | Rare, requires significant edge |

⚠️ Important: Anyone claiming 50%+ ROI is either:

- Lucky short-term (small sample size)

- Not calculating ROI correctly

- Lying

How to Calculate ROI

ROI = (Total Profit / Total Staked) × 100

Example structure:

After 100 bets:

Total staked: 100 × [Your stake per bet]

Total winnings: [Wins] × [Avg stake] × [Avg odds]

Total losses: [Losses] × [Avg stake]

Net profit = Winnings - Total staked

ROI = (Net profit / Total staked) × 100

Track this monthly to measure your actual performance.

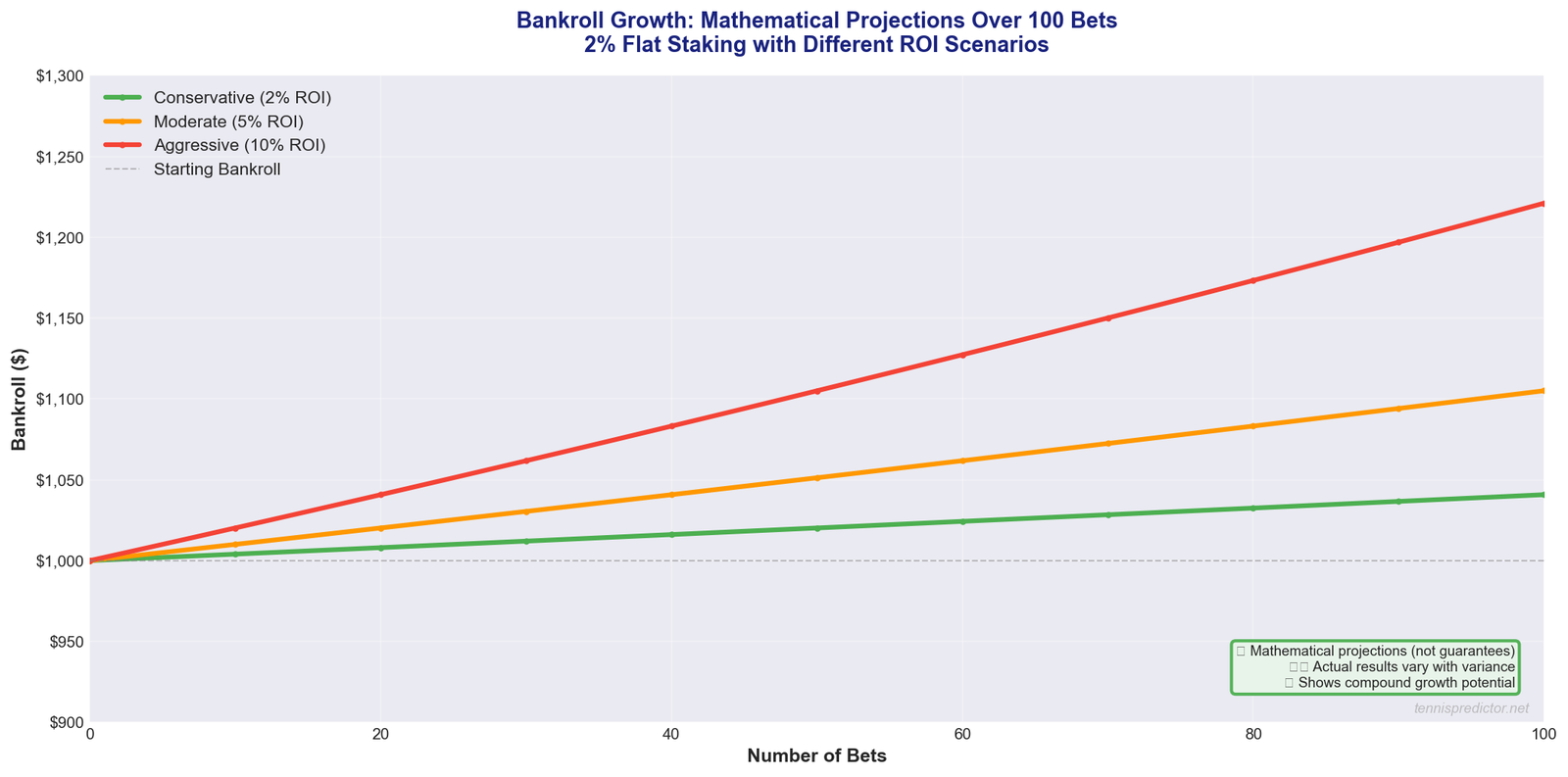

The Power of Compound Growth

Even modest ROI compounds significantly over time:

Mathematical projections showing bankroll growth over 100 bets with different ROI scenarios. 2% flat staking assumed. These are mathematical models, not guarantees.

Mathematical projections showing bankroll growth over 100 bets with different ROI scenarios. 2% flat staking assumed. These are mathematical models, not guarantees.

What these scenarios show:

- Conservative (2% ROI): Steady, low-risk growth to $1,020

- Moderate (5% ROI): Balanced approach reaching $1,050

- Aggressive (10% ROI): High-risk, high-reward to $1,100

Important: These are mathematical projections. Actual results depend on:

- Quality of value bets found

- Variance (bad luck stretches happen!)

- Discipline in bet selection

- Market conditions

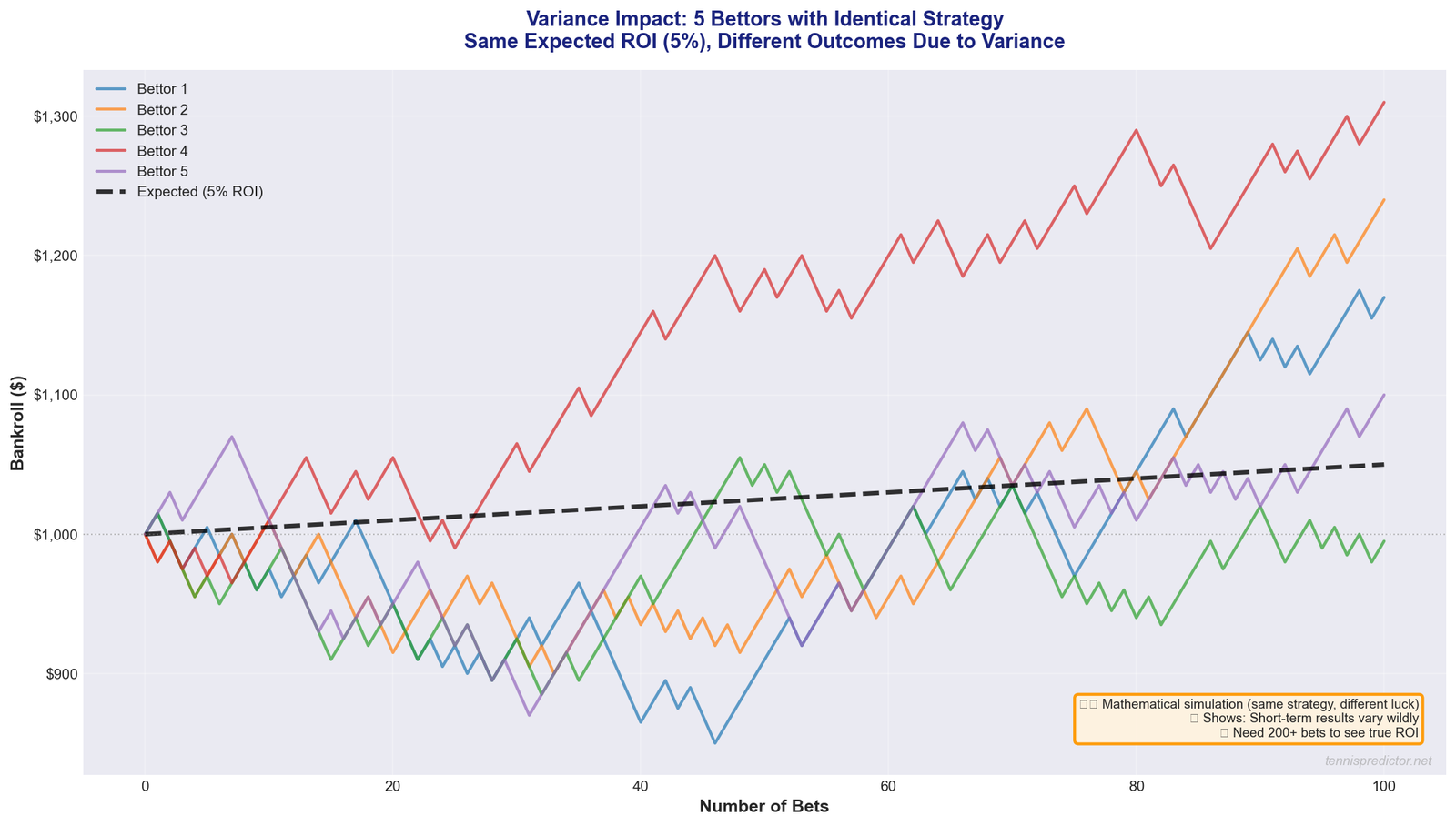

Why Variance Matters

Five bettors with identical strategy (60% win rate, 5% expected ROI) have drastically different outcomes over 100 bets due to variance. Some end up +$200, others barely break even.

Five bettors with identical strategy (60% win rate, 5% expected ROI) have drastically different outcomes over 100 bets due to variance. Some end up +$200, others barely break even.

Critical insight: Even with positive EV and good strategy, you can still:

- Lose 10+ bets in a row

- Be down 20% after 50 bets

- Take 200+ bets to reach expected ROI

This is why you need:

- Proper bankroll management (2% max)

- Patience (200+ bet minimum sample)

- Emotional discipline (don't panic during bad runs)

When to Bet and When to Skip

✅ BET when:

- Positive EV (+3% minimum edge)

- High confidence (65%+)

- No injury concerns

- Predictable opponent (low variance player)

- Value indicator shows "GREAT VALUE BET"

❌ SKIP when:

- Negative or marginal EV (<+2% edge)

- Low confidence (<60%)

- Injury red flags

- Unpredictable opponent (high variance player like Baez, Shapovalov)

- Models disagree (ML says 65%, Statistical says 50%)

⚠️ REDUCE STAKE when:

- Medium confidence (60-70%)

- Underdog bet (higher variance)

- First match after injury

- Marginal value (+2-3% EV)

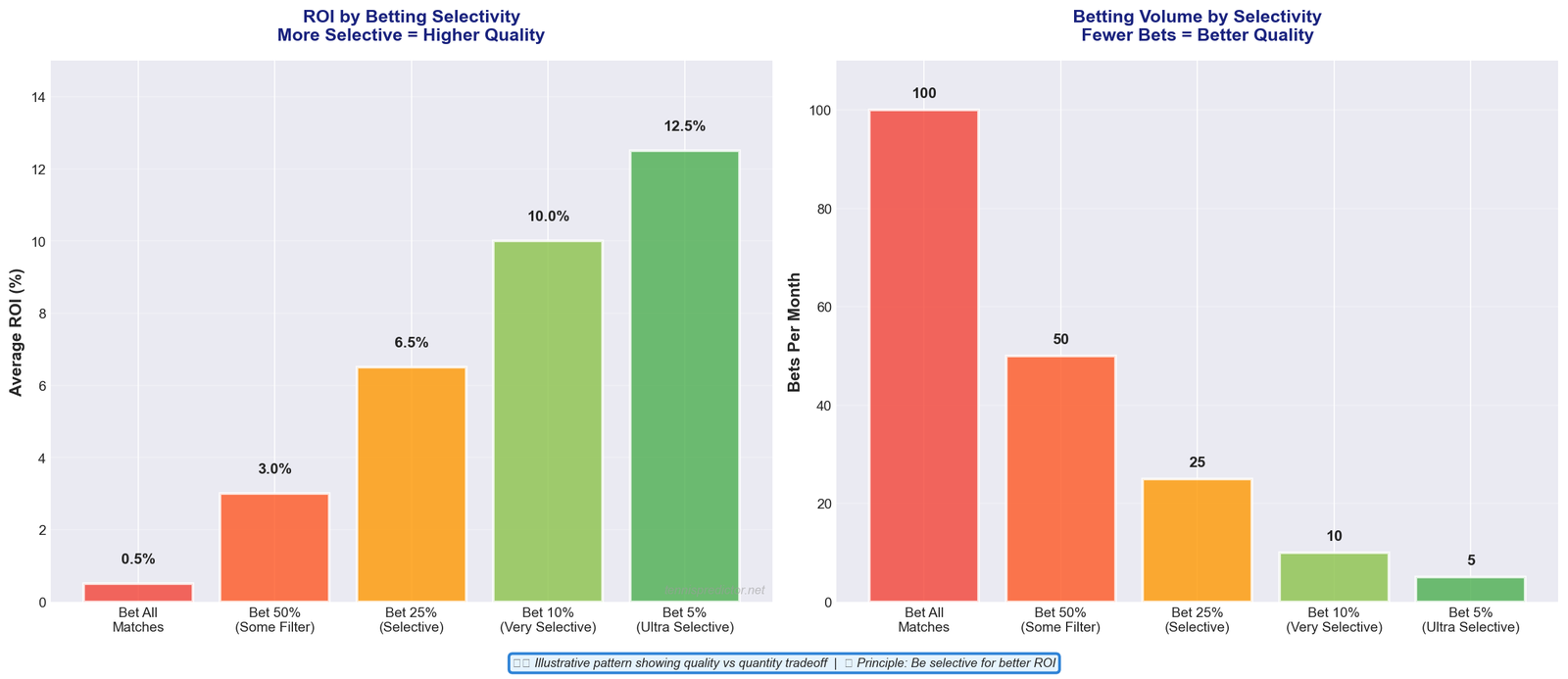

Quality Over Quantity: Be Selective!

Being more selective dramatically improves ROI. Betting only 5-10% of matches (ultra-selective) yields 10-12.5% ROI vs 0.5% ROI when betting everything.

Being more selective dramatically improves ROI. Betting only 5-10% of matches (ultra-selective) yields 10-12.5% ROI vs 0.5% ROI when betting everything.

Key principle: More bets ≠ More profit

- Bet all matches: 0.5% ROI, 100 bets/month (quantity over quality)

- Bet 50%: 3% ROI, 50 bets/month (some filtering)

- Bet 25%: 6.5% ROI, 25 bets/month (selective)

- Bet 10%: 10% ROI, 10 bets/month (very selective)

- Bet 5%: 12.5% ROI, 5 bets/month (ultra-selective - best quality)

Strategy: Target 10-25 bets per month with clear +5% EV. Skip everything else!

Tracking Your Performance

Use a simple spreadsheet to track every bet:

Essential Columns:

- Date

- Tournament

- Match

- Your Prediction (%)

- Bookmaker Odds

- Implied Probability (%)

- Edge (%)

- EV ($)

- Stake ($)

- Result (W/L)

- Profit/Loss ($)

- Running Bankroll ($)

- Running ROI (%)

Review monthly:

- Total bets placed

- Win rate vs expected

- Average EV

- Actual ROI

- Biggest wins/losses

Adjust strategy if:

- ROI < 0% after 50+ bets (your edge estimation needs improvement)

- Win rate significantly below predictions (model calibration issue)

- Variance too high (reduce bet sizing or be more selective)

Advanced: Finding Value Before Odds Drop

Pro tip: Bet early when lines open.

Why?

- Bookmakers set initial odds conservatively

- Sharp bettors move lines quickly

- Value disappears within hours

General pattern:

When line opens:

Odds may be wider (more value potential)

Less information priced in

Better edges available

After sharp money arrives:

Odds tighten (value reduced)

Market becomes more efficient

Edge shrinks or disappears

Strategy: Check our predictions early (we update 4x daily) and compare with fresh bookmaker lines to find the best value.

Conclusion: Value is Everything

Key Takeaways:

- EV > 0 is non-negotiable: Never bet negative EV, no matter how "sure" you are

- Edge matters more than win rate: 60% win rate at +10% EV beats 80% win rate at -2% EV

- Bankroll management saves you: 2% flat staking prevents ruin during bad runs

- Track everything: You can't improve what you don't measure

- Be patient: 100-200 bets minimum to judge your strategy

- Value disappears fast: Bet early when lines open

The Bottom Line:

Betting on Sinner at 1.05 odds (95% implied) when he has a 95% win probability = you lose money slowly.

Betting on Draper at 3.20 odds (31% implied) when he has a 42% win probability = you make money long-term.

Value betting is the ONLY sustainable path to profit.

Ready to find today's value bets? Check our Live Predictions Dashboard for matches with "GREAT VALUE BET" indicators.

Next Article: Bankroll Management: The Key to Long-Term Betting Success

Want to understand what features we analyze to find these value bets? Read our deep dive on The Features That Power Our Tennis Predictions.